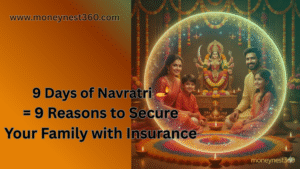

Buy Insurance This Navratri – Secure Your Family Like Maa Durga Protects Her Devotees :

Navratri is one of the most celebrated festivals in India. For nine days, we worship Maa Durga in her nine forms, each day representing power, health, prosperity, wisdom, and protection. Families come together to pray, fast, and celebrate with devotion.

Just as we seek Maa Durga’s blessings to protect us from evil and give us strength, we also have a responsibility to protect our own families in today’s uncertain world. One of the most practical and powerful ways to do that is through insurance.

Buying insurance during Navratri is not just a financial step; it’s a spiritual one too. Festivals are considered auspicious times to begin new journeys, and what better way to start than by securing your family’s future?

Here are 9 powerful reasons to buy insurance this Navratri:

1. Protection for Your Family – Just Like Maa Durga Protects Us

In Indian households, the earning member is often seen as the “protector” of the family. But life is unpredictable. Term insurance ensures that even if something happens to you, your family’s financial needs like daily expenses, school fees, and EMIs are taken care of.

2. Peace of Mind During Festivals

Festivals like Navratri, Diwali, and Pongal are meant for joy and togetherness. But without financial security, celebrations can feel incomplete. Insurance gives you mental peace so that you can celebrate festivals wholeheartedly without worrying about “what if something happens tomorrow”.

3. Secure Your Children’s Education & Marriage

Every Indian parent dreams of giving their children a good education and a grand wedding. But rising costs make it challenging. Child insurance and life insurance policies ensure that your children’s dreams don’t get compromised, even if you are not around to support them.

4. Medical Emergencies Don’t Wait for Festivals

Healthcare in India is becoming expensive. A single hospital bill can wipe out years of savings. A health insurance plan acts as a shield, covering your medical bills so you don’t have to borrow money or sell assets during emergencies.

5. Save Tax and Celebrate Savings

In India, saving tax is as important as saving money. Insurance premiums are eligible for deductions under Section 80C (up to ₹1.5 lakh) and health insurance premiums under Section 80D. This means you not only protect your family but also reduce your tax burden.

6. Start Auspicious Investments During Navratri

Navratri is believed to be a shubh muhurat (auspicious period) for new beginnings, whether buying gold, a new car, or a new home. Starting an insurance plan during this period is considered equally lucky, as it brings financial security along with blessings.

7. Insurance is Cheaper When You’re Young and Healthy

Most Indians delay insurance until they’re older, but premiums rise with age. This Navratri, take advantage of your health and youth to lock in lower premiums. The earlier you start, the less you pay, and the more coverage you get.

8. Build Wealth While You Protect

Many Indians prefer savings-linked insurance (like endowment plans, ULIPs, or money-back policies) because they combine protection with wealth creation. These plans help you grow your money systematically while ensuring your family is covered.

9. Leave Behind a Legacy for Your Family

In Indian culture, parents always think about “what will I leave behind for my children?” Insurance ensures your family gets a lump sum or regular income even in your absence, helping them continue their life with dignity.

Final Thoughts: Celebrate with Responsibility

Navratri teaches us about strength, devotion, and protection. By purchasing insurance, you are embodying these very values – protecting your family, ensuring their happiness, and preparing for life’s uncertainties.

This Navratri, don’t just gift your loved ones new clothes or sweets. Gift them financial security, peace of mind, and a future without fear.

💡 Remember: Insurance is not an expense, it’s an investment in your family’s happiness.

This Navratri, begin your journey towards protection and prosperity. Talk to an insurance advisor or visit trusted insurance portals to choose the right plan for your family. Let this festive season be the start of financial security for generations to come. Or reach out to us, and we will help you with the best insurance plans in the industry.

Please reach out here : Click Here

Facing issues with your insurance? Contact IRDAI

Nine days of devotion, nine reasons to insure! Start your protection journey this Navratri.

Frequently Asked Questions(FAQs)

1. When is the best time to buy insurance?

The earlier, the better. Buying insurance at a younger age is cheaper, as premiums are lower and health risks are minimal. Don’t wait until you fall sick or grow older—start early.

2. Are pre-existing diseases covered?

Yes, but usually after a waiting period of 2–4 years (varies by policy). For example, if you already have diabetes, it will be covered only after the waiting period.

3. What happens if I miss a premium payment?

Most insurers give a grace period (15–30 days). If you miss paying within that time, your policy may lapse. Always try to keep premiums up-to-date

4. Can NRIs buy insurance in India?

Yes, NRIs can purchase both life and health insurance in India. They need to complete KYC (PAN card, Aadhaar, passport, etc.) and medical tests as required.

5. Can I increase my coverage later?

Yes, many insurers allow top-ups or riders to increase coverage. You can also buy a new policy if your current cover is not enough.

6. What is co-payment in health insurance?

It means you share a part of the medical bill. Example: If co-payment is 20% and your hospital bill is ₹1,00,000, you pay ₹20,000 and the insurer pays ₹80,000.