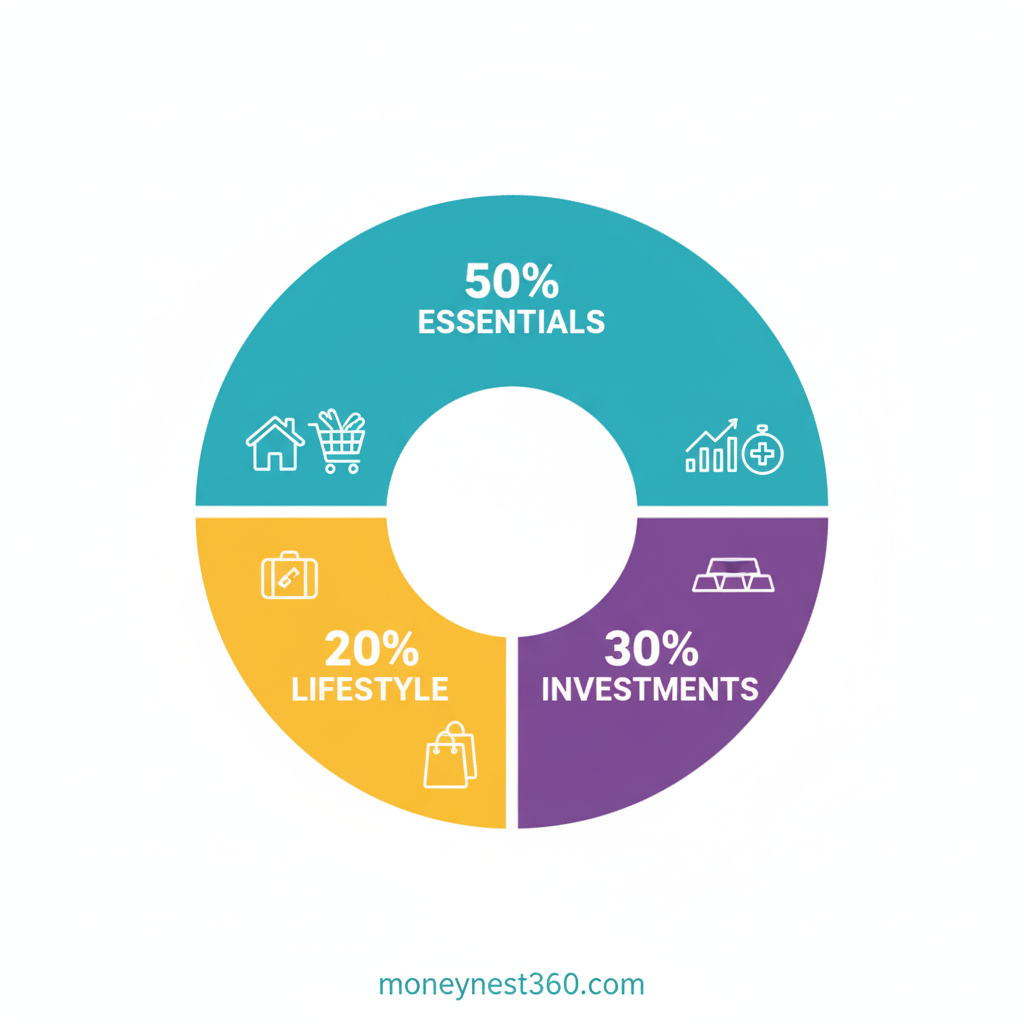

50-20-30 Budget Formula by MoneyNest360

In India, a majority of families belong to the middle class. Our economy still relies heavily on farming, followed by the service sector, small businesses, and other industries. But despite working hard, many people struggle financially because they spend everything they earn and don’t make savings a habit.

This often leads to serious financial problems in the future – medical emergencies, children’s education or retirement worries. That’s why “savings should be a daily habit“.

It doesn’t matter how much you earn – what truly defines your financial knowledge is how much you save and invest from what you earn.

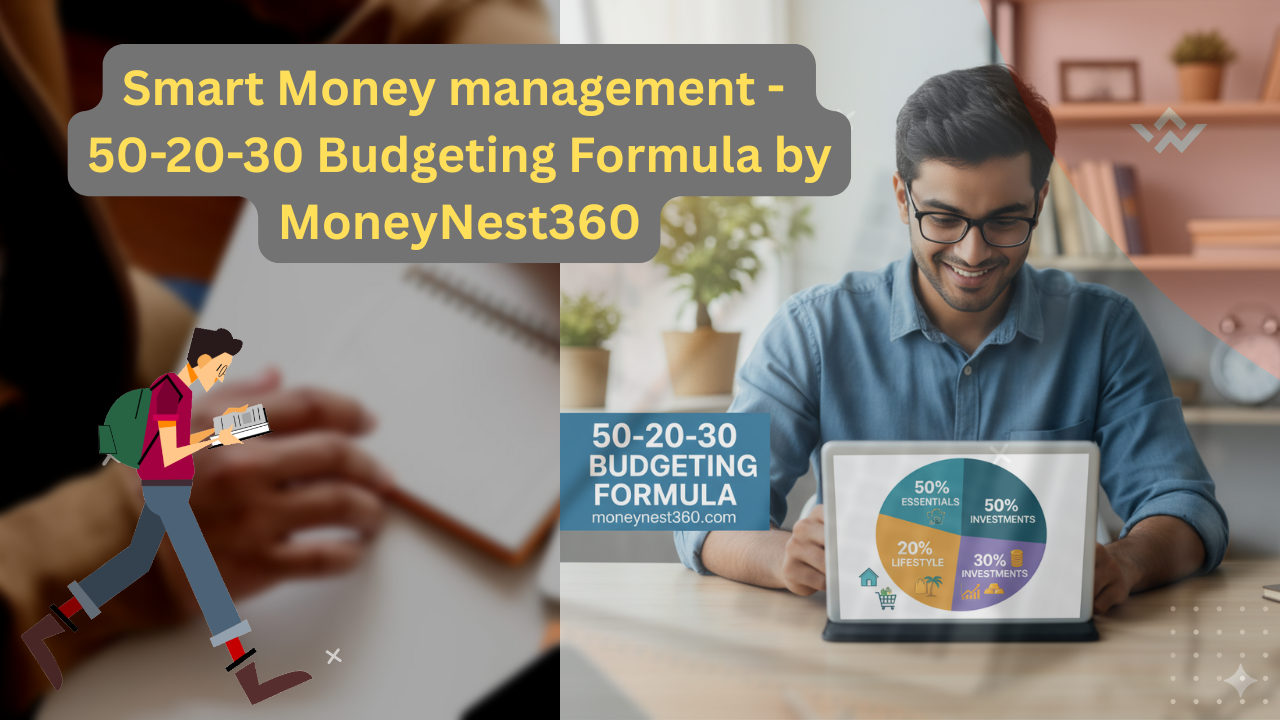

From my personal experience, I follow a slightly different budgeting method. While most people talk about the 50-30-20 rule, I strongly recommend the 50-20-30 formula. Let me explain.

Follow the 50-20-30 Budget Formula:

1. 50% for Essentials

Spend 50% of your income on your basic needs – rent, groceries, utility bills, EMIs and other essentials.

👉 Pro Tip: Your EMIs should never be higher than your monthly earnings. Over-borrowing can trap you in debt.

2. 20% for Lifestyle & Urgent Needs

Keep 20% for clothing, travel, dining out or any sudden urgent needs. This way, you can still enjoy life without feeling restricted.

3. 30% for Investments (Non-Negotiable)

The remaining 30% must go into investments. This is compulsory if you want long-term financial stability.

You can invest in:

- Fixed Deposits (FDs) or Recurring Deposits (RDs)

- Insurance (My Strong Recommendation for middle class families)

- Mutual Funds (SIPs) (My Strong Recommendation families)

- Gold or Sovereign Gold Bonds

- Stock Markets

- Real Estate (if affordable)

Also Read | The Golden Rule of Investment: Follow the 30% Rule + 6 Essential Steps

Example: Vinayak’s ₹40,000 Monthly Income

Vinayak earns ₹40,000 per month. Here’s how he applies the 50-20-30 formula:

Step 1: 50% Essentials → ₹20,000

- Rent: ₹10,000

- Groceries & household: ₹6,000

- Utility bills (electricity, internet, mobile): ₹2,000

- EMI (bike/car loan): ₹2,000

Step 2: 20% Lifestyle & Urgent Needs → ₹8,000

- Shopping & clothing: ₹3,000

- Dining out / Entertainment: ₹2,500

- Miscellaneous / urgent expenses: ₹2,500

Step 3: 30% Investments → ₹12,000

- SIP in Mutual Funds: ₹6,000

- Gold (Digital Gold / SGB): ₹3,000

- Fixed Deposit / RD: ₹3,000

What Happens if Vinayak Invests in SIP or Insurance

Case 1: SIP (Mutual Funds)

- Monthly investment: ₹12,000

- Duration: 20 years

- Expected annual return: 12%

Future Value: ≈ ₹1.04 Crore 🚀 or more

Case 2: Insurance (Traditional Endowment / ULIP)

- Monthly premium: ₹12,000

- Duration: 20 years

- Expected return: 4–6%

Future Value: ≈ ₹35–38 Lakhs

Smart Approach:

- Take a term insurance plan for protection (~₹3,000/month)

- Invest the remaining ₹9,000 in SIPs/Mutual Funds for long-term wealth creation.

My Personal Approach

I am currently following this example in my own life, and it has made a huge difference in how I manage my finances. By allocating 50% to essentials, 20% to lifestyle and urgent needs, and 30% to investments, I can cover daily expenses, enjoy leisure, and steadily build wealth for the future.

Even with a moderate salary, this method helps me save consistently, invest wisely, and stay financially secure – something I believe everyone should try.

Final Thoughts

Budgeting is not about restricting yourself – it’s about taking control of your money. The 50-20-30 formula ensures that you:

- Cover all your essential expenses without stress

- Enjoy life with some lifestyle flexibility

- Invest consistently to build long-term wealth

Even with a moderate salary like ₹30,000 or ₹40,000, following this approach can help you stay financially secure, achieve your goals, and face emergencies confidently.

💡 Remember: It’s not about how much you earn – it’s about how much you save, invest, and grow. Start small, be consistent, and let your money work for you.

Frequently Asked Questions(FAQs):

Q1: What is the 50-20-30 budget formula?

A: The 50-20-30 budget formula is a budgeting method where:

- 50% of your income goes to essentials (rent, groceries, bills, EMIs).

- 20% goes to lifestyle & urgent needs (shopping, travel, dining out).

- 30% goes to investments (SIPs, FDs, gold, stocks, real estate).

Q2: How is 50-20-30 different from 50-30-20?

A: The 50-20-30 formula emphasizes higher investments (30%) and slightly reduces lifestyle spending to prioritize long-term financial growth.

Q3: Can I follow this formula with a low salary (₹30,000 or less)?

A: Yes! Even with a moderate salary, the key is consistency. Adjust the amounts proportionally, and the habit of saving and investing will still help you build wealth over time.

Q4: Where should I invest my 30%?

A: Some smart options for Indian investors include:

- SIPs in Mutual Funds

- Fixed Deposits (FDs) or Recurring Deposits (RDs)

- Gold (Digital Gold / Sovereign Gold Bonds)

- Stock Market or Real Estate (if affordable)

💡 Pro Tip: Use term insurance for protection and invest the rest in SIPs for higher growth.

Q5: Is it necessary to track every expense?

A: Yes, tracking helps you understand where your money goes and prevents overspending. Use apps like Walnut, Money View , PayTM Money or Use Notebook and Excel Sheet for convenience.