Savings Should Be a Daily Habit

In today’s fast-paced world, financial security has become one of the most important goals for every individual. Yet, most people struggle to save money consistently. The truth is simple: it’s not about how much we earn, but how much we save that shapes our financial future.

Unfortunately, many of us have a common bad habit – we tend to spend whatever we earn. This leaves little room for savings and eventually leads to financial stress. To overcome this, I started practicing a few simple strategies in my own life. These small steps not only helped me control my spending but also boosted my financial growth.

Why Savings Must Be a Daily Habit?

Every individual should make saving a part of their lifestyle. Think of it as a daily habit, just like eating or exercising. Savings don’t have to be huge amounts; even small adjustments in daily expenses can make a big difference over time.

In the same way, many of our daily habits are not truly essential. Whether it’s frequent online food orders, unnecessary subscriptions, or impulse shopping, these are areas where small changes can lead to meaningful savings. By reducing such avoidable expenses, you can redirect the money towards investments, emergency funds, or future goals.

You may wonder, “What will I really gain by avoiding small expenses?” The answer lies in consistency. When you track your daily spending and identify even small areas to save, those savings accumulate and become tomorrow’s income.

👉 Remember: Today’s savings are tomorrow’s income

4 Key Reasons You Can’t Ignore:

Avoid Financial Stress

Without savings, unexpected expenses like medical emergencies, vehicle repairs, or sudden bills can throw your finances off balance.

Build Long-Term Wealth

Regular savings, even in small amounts, can grow significantly over time thanks to compound interest.

Achieve Your Goals

Daily savings make it easier to afford your goals – buying a house, traveling, or investing in education – without taking loans.

Develop Financial Discipline

Making saving a habit teaches discipline, helping you make smarter spending decisions every day.

Also Read | Top 10 Term Insurance Plans in India 2025 -Smart Wealth & Protection in One

How to Make Savings a Daily Habit

1. Pay Yourself First

As soon as your salary arrives, transfer a fixed portion into a separate savings or investment account before spending on anything else.

2. Start Small

Even saving ₹50–₹100 per day consistently adds up over time. For example:

- ₹100/day → ₹3,000/month → ₹36,000/year

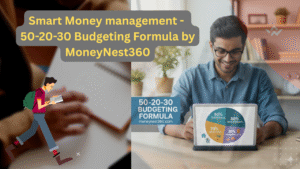

3. Use the 50-20-30 Budget Formula

Allocate your income like this:

- 50% Essentials: Rent, groceries, bills, EMIs

- 20% Lifestyle & Urgent Needs: Shopping, travel, dining out

- 30% Investments: SIPs, FDs, gold, mutual funds, or real estate

💡 Example:

If Vinayak earns ₹30,000/month:

- Essentials: ₹15,000

- Lifestyle: ₹6,000

- Investments: ₹9,000

Investing the 30% regularly in SIPs or insurance can grow into significant wealth over 10–20 years.

4. Automate Your Savings

Set up automatic transfers from your salary account to your savings or investment accounts. This ensures you never miss a deposit.

5. Track Your Daily Expenses

Use apps like Walnut, Money View or PayTM Money to record every expense. Even small expenditures like ₹50 chai breaks add up over time.

Tips to Make It Stick

- Keep your savings separate from your spending account.

- Reward yourself occasionally, but don’t touch your investments.

- Set clear financial goals with timelines.

- Regularly review your budget and adjust based on changes in income or expenses.

Final Thought

Financial discipline doesn’t come overnight – it comes with habits. If you make saving a daily practice, your money will start working for you instead of you constantly worrying about money. It’s not about earning lakhs, it’s about managing thousands wisely.

So, start small. Skip that extra tea, reduce an impulse buy, and save that amount. Over time, these tiny savings will grow into a strong financial cushion for your future.

✨ Small savings today create big opportunities tomorrow. Make saving your daily habit, and your future self will thank you.

Frequently Asked Questions(FAQs)

1. What are easy ways to save money daily?

A: Track daily expenses, reduce unnecessary spending (like extra tea or snacks), automate small transfers to savings or investments, and avoid impulse purchases.

2. Should I invest my daily savings or keep it as cash?

A: Investing is recommended. Options include SIPs, FDs, gold, or insurance-linked plans. This helps your savings grow faster than keeping cash idle.

3. Why should I save money daily?

A: Saving daily builds a strong financial habit. Even small amounts, like ₹20–₹50, accumulate over time, helping you create an emergency fund or investment corpus. Consistency matters more than income size.