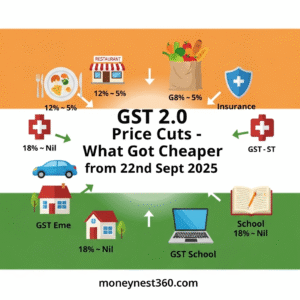

What Got Cheaper After GST 2.0?

GST 2.0 finally goes live today – 22nd September 2025 – marking one of the biggest tax reforms since GST was first rolled out in 2017.

With this reform, the complex multi-slab system (0%, 5%, 12%, 18%, 28% + cess) has been simplified into just two standard slabs – 5% and 18%. while retaining Nil (0%) for essential items and a 40% demerit slab for sin/luxury goods.

From today onward, millions of consumers will start noticing price drops across daily essentials, FMCG, medicines, cars, electronics, housing materials, and even insurance premiums – which are now GST-free.

For households, this means lower grocery and healthcare bills, for industries it brings simplified compliance, and for the economy, the government hopes to boost consumption and affordability.

This blog breaks down sector-wise which items got cheaper under GST 2.0, what their earlier tax rates were, what they are now, and how it impacts you as a consumer.

Household & FMCG Essentials: Everyday Savings You’ll Notice Immediately

What’s changed? Many everyday items that were taxed at 12–18% have now been moved down to 5% or even Nil.

| Item | Before GST 2.0 | After GST 2.0 | Impact |

| Packaged milk (UHT/Tetra) | 5% | Nil | Becomes cheaper for families with kids |

| Butter, ghee, cheese | 12% | 5% | Lower Prices |

| Biscuits & cookies | 18% | 5% | Popular FMCG item drops sharply. |

| Soap, shampoo, toothpaste | 18% | 5% | Personal care costs fall. |

| Hair oil | 18% | 5% | Household essentials cheaper |

| Detergents | 18% | 5% | Lower laundry costs. |

| Baby Diapers | 18% | 5% | Big relief for parents |

| Razors & Blades | 18% | 5% | Grooming costs reduce. |

| Ice cream & Chocolates | 18% | 5% | Affordable treats for kids. |

Food & Restaurants: Dining Out Just Got Cheaper

What’s changed? Dining out and packaged foods see a big cut.

| Item | Before GST 2.0 | After GST 2.0 | Impact |

| Restaurant food (non-AC, no ITC) | 12% | 5% | Eating out cheaper |

| Restaurant food (AC, earlier 18%) | 18% | 5% | Big savings for families. |

| Pizza base, parathas, khakhra | 5% | Nil | Daily breads now tax-free. |

| Packaged fruit juices | 12% | 5% | Healthier drink options cheaper. |

| Confectionery (candies, sweets) | 18% | 5% | Kids’ treats cheaper. |

| Breakfast cereals | 12% | 5% | Morning meals lighter on pocket. |

| Ready-to-eat mixes | 18% | 5% | Affordable convenience foods. |

| Tea & coffee (branded packs) | 12% | 5% | Everyday beverages cheaper. |

| Bottled water | 18% | 5% | Basic hydration cost drops |

Also Read: Bachat Utsav Begins! GST 2.0 to Cut Prices and Boost Savings for Every Indian | MoneyNest360

Automobiles : From Bikes to EVs, Driving Costs Less Now

What’s changed? GST on vehicles & parts cut from 28% to 18% (except luxury/sin).

| Item | Before GST 2.0 | After GST 2.0 | Impact |

| Small Cars | 28% | 18% | Car prices fall by ~10% |

| Two-wheelers (<350cc) | 28% | 18% | Affordable mobility. |

| Auto parts (brakes, filters, etc.) | 28% | 18% | Cheaper maintenance. |

| Tyres | 28% | 18% | Lower replacement costs. |

| Helmets | 18% | 5% | Road safety gear cheaper |

| Car batteries | 28% | 18% | Affordable spare parts. |

| Car accessories (wipers, mats) | 28% | 18% | Vehicle upkeep costs reduce. |

| Electric scooters | 5% | 5% | No change, still affordable. |

| Luxury cars | 28% + Cess | 40% | Remain expensive. |

Fashion & Lifestyle: Clothes, Shoes & Accessories Made Affordable

What’s changed? Middle-class clothing gets cheaper.

| Item | Before GST 2.0 | After GST 2.0 | Impact |

| Garments ≤ ₹1,000 | 5% | 5% | Same, but threshold raised. |

| Garments ₹1,000 – ₹2,500 | 12% | 5% | Mid-range clothing cheaper. |

| Premium apparel >₹2,500 | 18% | 18% | No major change. |

| Footwear ≤ ₹1,000 | 5% | 5% | Affordable shoes unchanged |

| Footwear ₹1,000–₹2,500 | 12% | 5% | School shoes cheaper. |

| Leather goods (wallets, belts) | 18% | 5% | Accessories cheaper |

| Handbags | 18% | 18% | High-end remains same |

| Sarees(Branded) | 5% | Nil | Cultural wear tax-free |

| Imitation Jewellary | 18% | 5% | Budget-friendly ornaments |

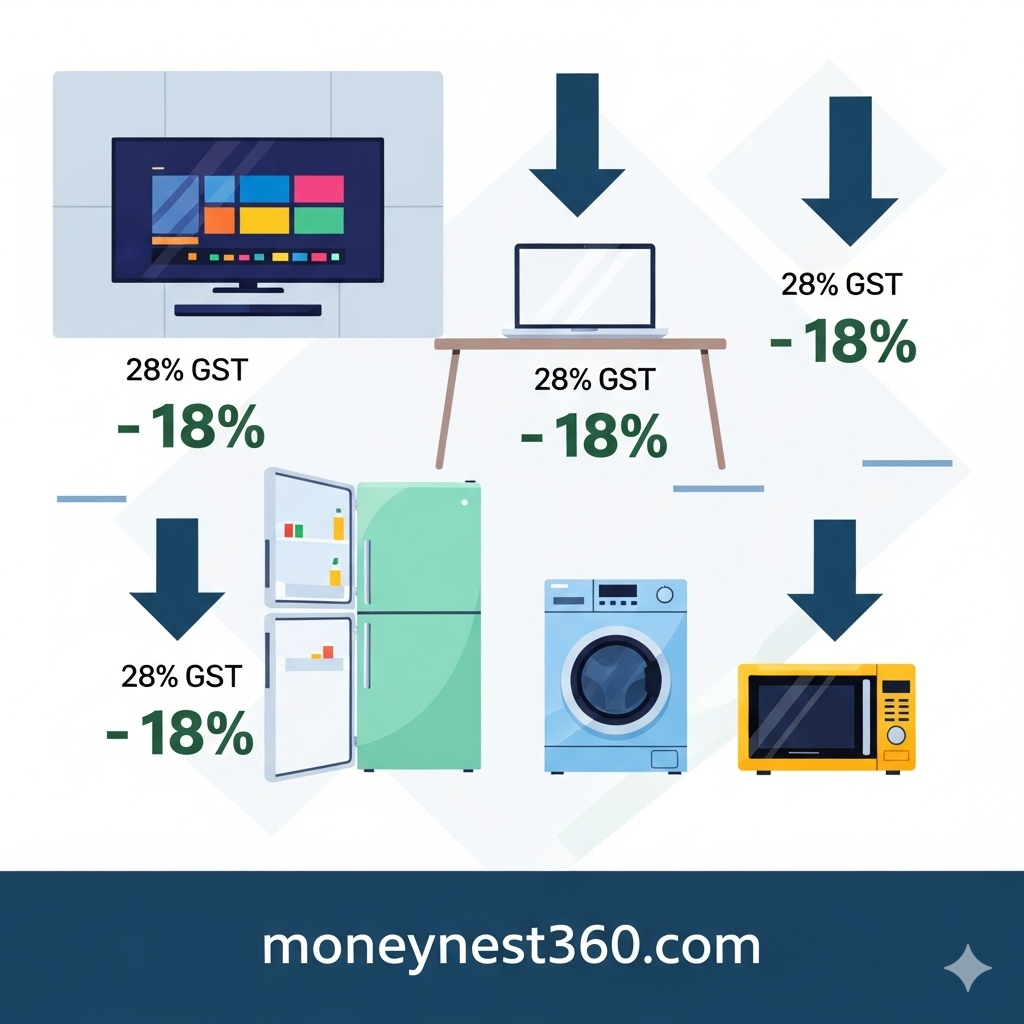

Electronics & Appliances: Home Gadgets at Friendlier Prices

What’s changed? Big appliances shift from 28% → 18%.

| Item | Before GST 2.0 | After GST 2.0 | Impact |

| Refrigerators | 28% | 18% | Cheaper appliances. |

| Washing machines | 28% | 18% | Savings on big-ticket items. |

| Air-conditioners | 28% | 18% | Home cooling cheaper. |

| Televisions (large screens) | 28% | 18% | Affordable home entertainment. |

| Fans & coolers | 18% | 5% | Lower household electricity items. |

| Mixers & grinders | 18% | 5% | Kitchen appliances cheaper. |

| Microwave ovens | 18% | 5% | Affordable convenience. |

| Mobile phones | 18% | 18% | No change. |

| Laptops | 18% | 18% | No change. |

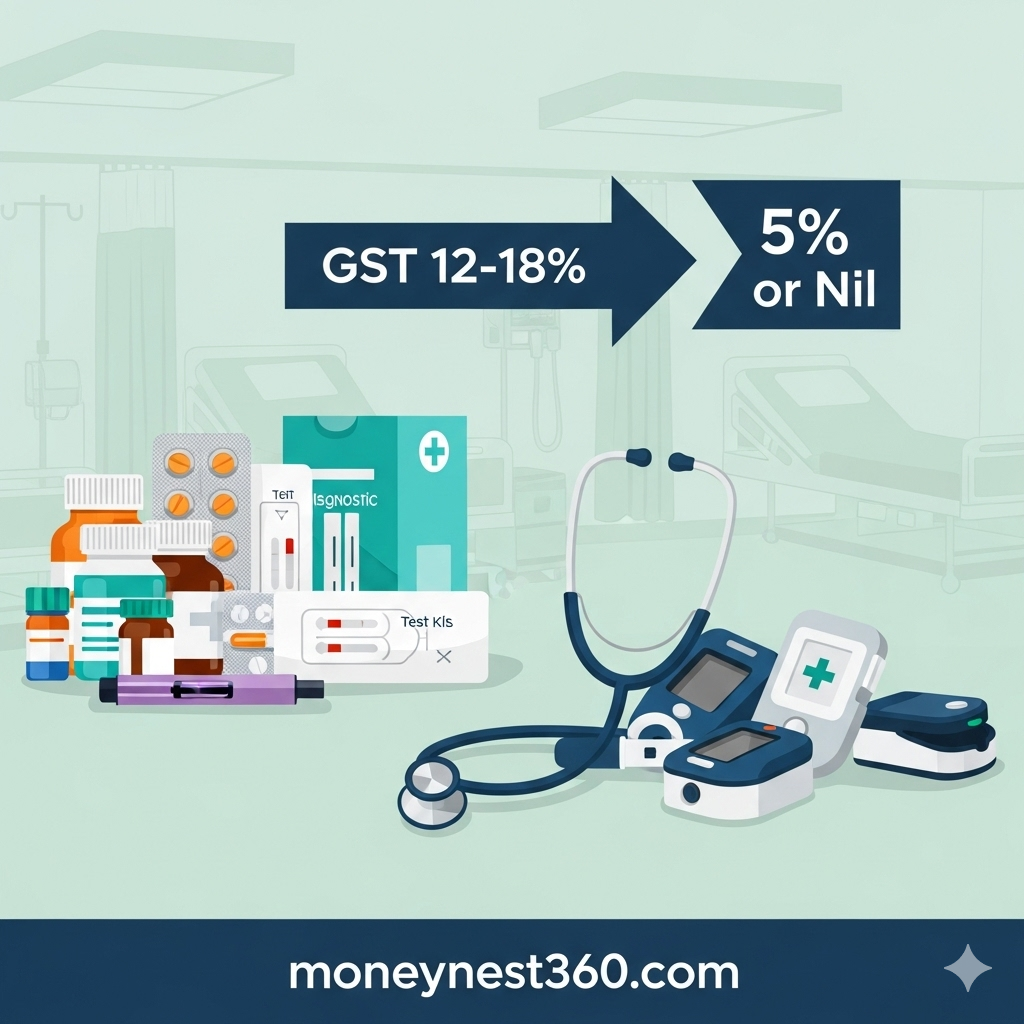

Healthcare & Medicines: Relief for Patients and Families

What’s changed? Life-saving medicines & devices cheaper.

| Item | Before GST 2.0 | After GST 2.0 | Impact |

| Cancer medicines (33 types) | 12% | Nil | Life-saving drugs free of GST. |

| Insulin | 12% | 5% | Affordable for diabetics. |

| Cardiac stents | 12% | 5% | Life-saving devices cheaper. |

| Diagnostic kits | 18% | 5% | Lower testing costs. |

| Syringes | 12% | 5% | Essential supplies cheaper. |

| Paracetamol & basic drugs | 12% | 5% | Day-to-day meds cheaper. |

| Wheelchairs & medical aids | 18% | 5% | Accessibility items affordable. |

| Surgical gloves | 12% | 5% | Cheaper supplies for hospitals. |

| Vaccines | 5% | Nil | Public health boost. |

Real Estate & Construction: Affordable Housing Gets a Boost

What’s changed? Materials cheaper = lower home-building costs.

| Item | Before GST 2.0 | After GST 2.0 | Impact |

| Cement | 28% | 18% | Lower construction costs. |

| Steel rods & bars | 18% | 18% | Stable. |

| Bricks | 12% | 5% | Cheaper home building. |

| Tiles, Marble & granite | 28% | 18% | Interior costs drop. |

| Paints | 28% | 18% | Cheaper home décor. |

| Sanitary ware | 28% | 18% | Affordable bathrooms. |

| Electrical wiring & switches | 28% | 18% | Lower interior costs. |

| Roofing sheets | 18% | 5% | Rural housing cheaper. |

| Plywood | 28% | 18% | Affordable furniture making. |

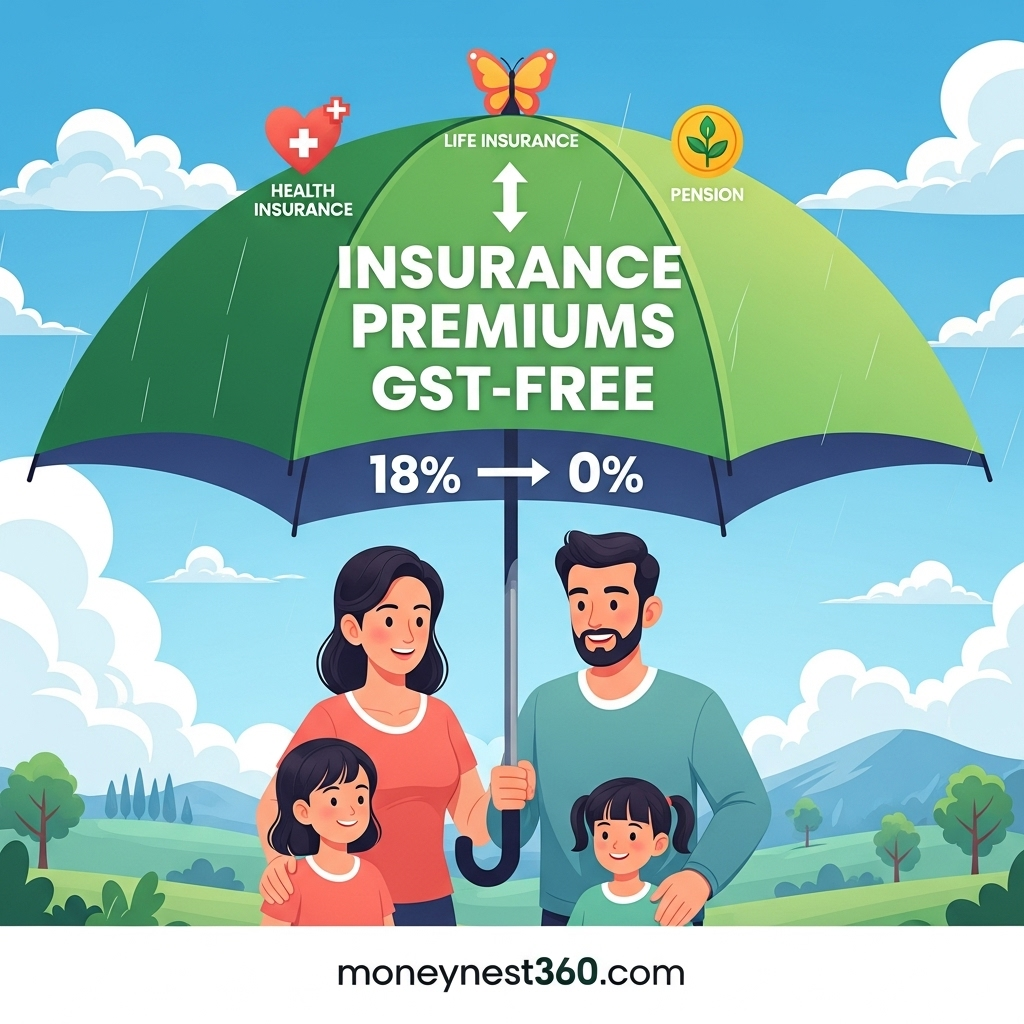

Insurance (Life & Health): Biggest Relief for Policyholders

Biggest relief comes in insurance. From today, life & health insurance premiums are GST-free.

The biggest relief under GST 2.0 comes for policyholders in the insurance sector. Until now, both life and health insurance premiums attracted 18% GST, making protection and savings products costlier for individuals and families. From today, 22 September 2025, all life and health insurance products have been moved to the Nil (0%) category, meaning customers will no longer pay GST on premiums.

This change directly impacts almost every type of insurance product. Term insurance, health insurance, ULIPs, endowment plans, pension/annuity products, and riders like accidental or critical illness covers are now GST-free. Even group health insurance for employees and micro-insurance products for rural families are exempt, making financial protection more affordable and accessible. Reinsurance of life and health policies also benefits from this move, easing cost pressures on insurers.

Note: While GST removal makes premiums cheaper, insurers may raise base premium rates slightly (3–5%) to offset loss of input tax credit. But net benefit to policyholders is still positive

Travel & Hospitality: Cheaper Stays and Airfares Under GST 2.0

What’s changed? Hotel stays & flights more affordable.

| Item | Before GST 2.0 | After GST 2.0 | Impact |

| Economy flight tickets | 5% | 5% | No change. |

| Business class flights | 12% | 18% | Becomes costlier. |

| Hotel rooms ≤ ₹7,500 | 12% | 5% | Stays cheaper. |

| Hotel rooms > ₹7,500 | 18% | 18% | No change. |

| Tour packages | 18% | 5% | Travel more affordable. |

| Bus transport (private AC) | 18% | 5% | Affordable luxury travel. |

| Rail catering | 12% | 5% | Railway food cheaper. |

| Holiday resorts | 18% | 5% | Boost to tourism sector. |

Final Thoughts

From 22nd September 2025, GST 2.0 is transforming your shopping bill, medical expenses, housing costs, travel, and even insurance premiums.

- Essentials = Nil or 5%

- Standard goods & services = 18%

- Luxury/sin goods = 40%

This is expected to make life more affordable for households, while also simplifying compliance for businesses. Over time, the reform aims to boost consumption, lower inflation, and give the economy a demand push.

Source: Central Board Of Indirect Taxes & Customs

Frequently Asked Questions(FAQs)

1. What does GST 2.0 mean for health insurance premiums from 22 September 2025?

Under GST 2.0, all individual life and health insurance premiums (term, endowment, family floater, etc.) become GST-free (0%) from 22 September 2025.

2. Which medicines and medical devices got cheaper under the new GST rate?

Many common medicines previously taxed at 12-18% are now under a 5% slab, while about 33 essential/life-saving drugs and therapies (for cancer, rare diseases etc.) are fully exempt (Nil rate). Devices like glucometers, diagnostic kits, bandages have also moved to lower GST.

3. Which daily food items are now tax-free under GST 2.0?

Items like UHT milk, pre-packaged paneer/chenna, Indian breads (roti, paratha, khakhra, pizza base, etc.) have been moved to the 0% (Nil GST) slab.

4. Will existing insurance policies get benefits from GST 2.0?

The GST exemption applies to renewal premiums due after 22 September 2025 or new policies issued after that date. Old premiums already paid, or advance lump-sum premiums paid before this date, generally will not be adjusted or refunded

5. Which items now attract higher GST or cost more under GST 2.0?

Items considered luxury or “sin goods” (like soft drinks, certain large/super luxury cars, tobacco products) have been moved to the 40% GST slab

6. Does GST 2.0 impact real estate?

Yes. Affordable housing is now taxed at 5%, while construction materials like cement and tiles moved from 28% to 18%, making property purchases and construction more budget-friendly.

7. Will GST 2.0 reduce prices immediately in the market?

Yes, consumers will start seeing price reductions immediately, but in some cases, companies may adjust base prices to offset loss of input tax credits. Still, the net effect remains positive for consumers

8. What is the overall goal of GST 2.0?

The government’s aim is to simplify taxation, lower household costs, boost consumption, and increase compliance while maintaining higher taxes on luxury and sin goods