Savings Plan – Why They Are Important?

Every family has dreams and responsibilities – like children’s education, marriage, buying a house, or planning for retirement. To achieve these, just earning money is not enough; we must save and invest wisely.

A Savings Plan is a type of life insurance policy that helps you in two ways:

- Protection → If something happens to you, your family gets financial support.

- Savings/Returns → At the end of the policy term, you receive a guaranteed amount which can be used for your goals.

Benefits of Savings Plans:

- Disciplined savings (you save regularly every year)

- Life cover for family security

- Guaranteed returns at maturity

- Options to take lump sum or regular income

- Tax benefits under Section 80C & 10(10D)

In simple words: A Savings Plan is like “One Stone – Two Birds”: Insurance + Savings.

Also Read: Why Life Insurance Is the Smartest Way to Create Wealth and Protect Your Family?

Here: Tata AIA offers simple, easy-to-understand savings insurance plans that help you:

- Secure your family with life cover

- Get guaranteed returns for future needs

- Achieve financial goals step by step

With proper planning, you can create a secure future for yourself and your loved ones

Fortune Guarantee Plus helps you save smartly, protect your family, and plan your future with confidence.

Why Fortune Guarantee Plus is the Best Savings Plan for Your Family

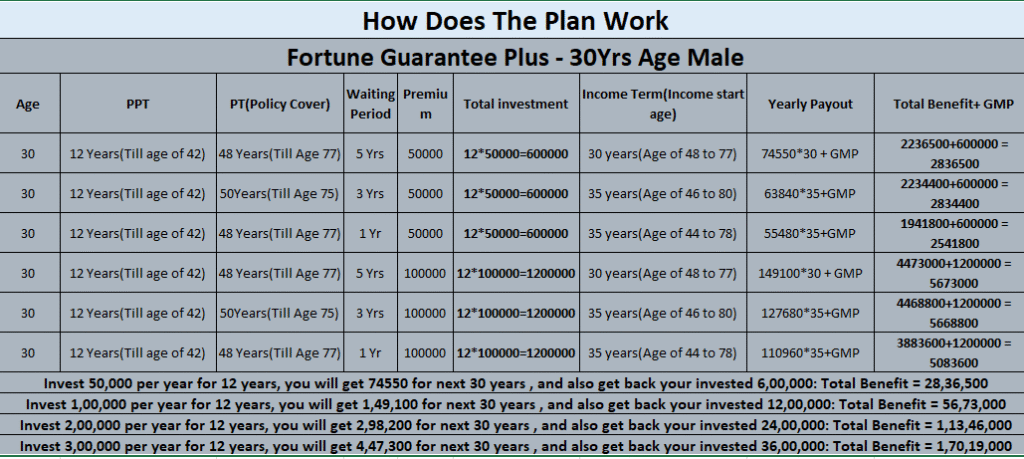

Fortune Guarantee Plus – Policy Details

This plan is designed to provide guaranteed benefits along with life protection. It can be useful for both children’s education planning and parents’ retirement planning.

✅ Basic Eligibility

Entry Age (Min – Max): From 1 year to 60 years.

Minimum Premium: ₹24,000 per year.

Maximum Premium: No Limit

✅ Premium Payment Term

You can choose to pay premiums for 5 years to 12 years.

This means, depending on your financial comfort, you can decide how long you want to pay.

✅ Policy Term (Duration of the policy)

You can select a policy term of 13 years to 17 years.

A waiting period of 1 to 5 years applies (this depends on the chosen plan structure).

✅ Life Insurance Coverage

Life cover is provided till the end of the policy term.

The life cover (sum assured) is usually 10 to 12 times the annual premium you pay.

Example: If you pay ₹1 lakh yearly, your life cover will be ₹10–12 lakhs.

✅ Income Term Option

You can also choose an Income Term for 20 years to 45 years depending on your financial needs.

In this, you receive regular income payouts after a certain period, which can support:

Child’s education expenses

Marriage planning

Parents’ retirement income

✅ Optional Riders in Fortune Guarantee Plus

1. Accidental Death Benefit Rider

- If the policyholder dies due to an accident, the family gets an extra lump sum amount along with the life cover.

- Example: If the life cover is ₹10 Lakhs and an accidental rider of ₹5 Lakhs is added, then in case of accidental death, the family will receive ₹15 Lakhs.

Also Read: Right Age to Buy a Term Insurance Plan in India?

2. Critical Illness Cover Rider

- Provides financial help if the policyholder is diagnosed with major illnesses like cancer, heart attack, kidney failure, etc.

- Example: If you are diagnosed with a critical illness, a lump sum amount (say ₹5 Lakhs) will be given immediately, so you can focus on treatment without worrying about money.

3. Disability Cover Rider

- Gives protection if the policyholder becomes permanently disabled due to an accident and cannot earn anymore.

- Example: If an accident causes permanent disability, the rider ensures either the future premiums are waived off or an income/benefit is provided to support the family.

👉 These riders act like extra shields of protection along with your savings plan.

Fortune Guarantee Plus – With vs Without Riders

| Feature / Situation | Without Riders | With Riders (Extra Protection) |

|---|---|---|

| Normal Life Cover | Family gets the sum assured (example: ₹10 Lakhs). | Family gets the same sum assured (₹10 Lakhs). |

| Accidental Death | Family only gets ₹10 Lakhs (basic life cover). | Family gets ₹10 Lakhs + extra ₹5 Lakhs (Accidental Death Rider). |

| Critical Illness (e.g., Heart Attack, Cancer) | No financial support for medical treatment. | Family/policyholder gets lump sum (e.g., ₹5 Lakhs) for treatment expenses. |

| Permanent Disability (can’t earn anymore) | Policy may lapse if premiums are unpaid. | Rider ensures future premiums are waived off OR regular income is given to family. |

| Overall Protection | Limited – only life cover + guaranteed income. | Comprehensive – Life cover + Income + Extra financial support in emergencies. |

🎯 How It Helps Customers

- For Children’s Education – Parents can plan funds for higher studies and marriage by choosing the income benefit option.

- For Parents’ Retirement – They can select the income term to receive regular payouts during retirement, ensuring financial independence.

- For Family Protection – Provides life cover during the policy term, protecting the family against uncertainties.

👉 In simple words:

This policy gives you life insurance + guaranteed returns + flexible income options. You pay for a fixed number of years, stay covered for the chosen term, and also get back either a lump sum or income as per your need.

Also Read: How to Withdraw Your PF Amount (Provident Fund) Online: A Step-by-Step Guide

3 thoughts on “Are You Looking For Best Savings Plan?”