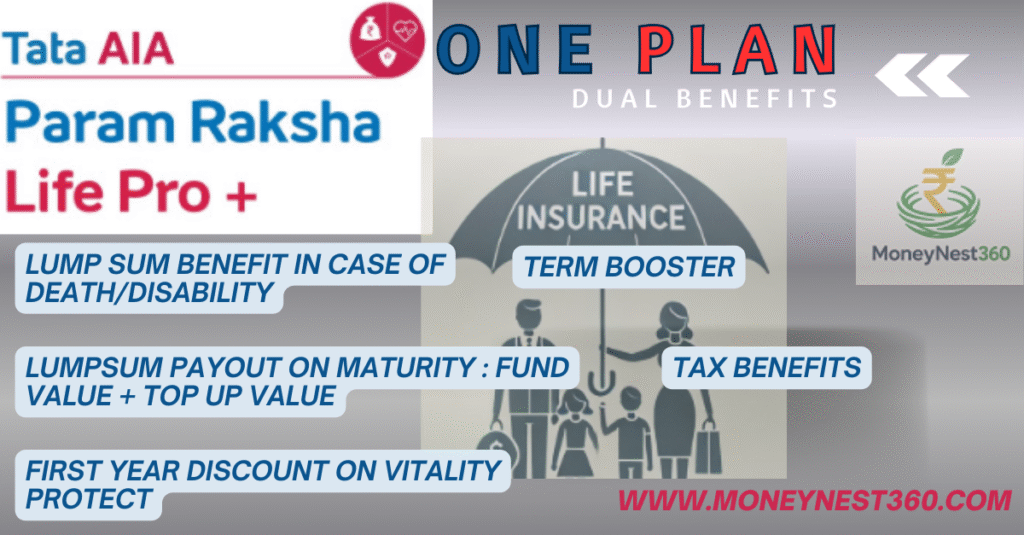

Don’t Just Protect Life… Build Wealth Too with Param Raksha

When it comes to protecting your family, just life insurance is not enough. You also need a shield against death, disease, and disability, while planning for future wealth creation.

That’s exactly what Tata AIA Param Raksha solution offers – a 3-in-1 benefit:

> Protection (Death, Disease, Disability)

> Savings for retirement or wealth creation

> Rewards for staying healthy

Key Features of Param Raksha

- Comprehensive cover – Death, Disability, Critical Illness, Hospitalization

- Accidental Death Benefit – Extra payout in case of accidental death (2X if accident happens in public transport)

- Accidental Disability Benefit – Payout if accident causes total & permanent disability (2X in public transport)

- Critical Illness Cover – Protection against life-threatening diseases

- Term Booster – Additional payout on death or diagnosis of terminal illness

- Market-linked maturity benefits – Grow your wealth like investments (ULIP-linked savings)

- Flexible premium payments – Choose how long you want to pay

- Tax Benefits – Deductions under section 80C & 80D (as per IT laws)

- Wellness Rewards – Earn benefits if you stay healthy (like Vitality program)

Param Raksha Life Pro Plus – Policy Details

Here’s a closer look at Param Raksha Life Pro Plus, one of the popular options under Param Raksha:

- Eligibility & Entry Age

👉 Minimum entry age: 18 years

👉 Maximum entry age: 65 years

👉 Minimum annual income required: ₹3 lakhs - Life Insurance Coverage

👉 Minimum coverage: ₹50 lakhs

👉 Maximum coverage: No Limit - Premium Payment Options

👉 Limited Pay (pay for 5, 7,10, or 12 years only.. Depends on customer choice)

👉 Regular Pay (pay throughout policy term) - Policy Term

👉 Minimum: 30 years

👉 Maximum: 100 years (or till age 100) - Investment & Returns

👉 Premium (after deducting rider charges) is invested in the market

👉 Returns depend on market performance - Death Benefit

👉 Nominee receives higher of:- Life Insurance Cover, OR

- Fund Value (returns from investment)

- Maturity Benefit

👉 If policyholder survives till maturity → maturity benefit = Fund Value - Partial Withdrawals

👉 Available after 5 years (for emergencies) - Optional Riders

👉 Accidental Death Benefit

👉 Accidental Total & Permanent Disability - Premium Factors

👉 Depends on age, life cover, payment term, and policy tenure

👉 Younger you are = lower premium + full benefits

💡 Example to Understand

- Ravi (30 years, buys Term Plan): Pays ₹10,000 per year → If he dies in 20 years, family gets ₹1 Cr. If he survives, returns = ₹0.

- Arjun (30 years, buys Param Raksha Life Pro Plus): Pays ₹50,000 per year →

✅ Family gets ₹50 lakhs life cover + Accidental & Disability cover.

✅ If he survives, maturity value may be ₹40–50 lakhs (based on market growth).

✅ He can withdraw part of the money after 5 years for emergencies.

✅ He earns health rewards for staying fit.

👉 Clearly, Param Raksha balances Protection + Savings + Flexibility.

Param Raksha vs Term Plan – Key Differences

| Feature / Benefit | Normal Term Plan | Param Raksha (Tata AIA) |

|---|---|---|

| Life Cover | ✅ Yes (pure death benefit only) | ✅ Yes (Death + Disability + Disease) |

| Accidental Death / Disability Cover | ❌ Not included (need to buy extra rider) | ✅ Included (2X payout in case of public transport accident) |

| Critical Illness Cover | ❌ Needs rider | ✅ Built-in option |

| Hospitalization Cover | ❌ No | ✅ Yes (with Vitality Protect) |

| Maturity Benefit (Returns) | ❌ No payout if you survive | ✅ Yes – Market-linked returns + refund of premiums in some plans |

| Wealth Creation | ❌ Not possible | ✅ Yes – Investment-like growth + loyalty boosters |

| Rewards for Staying Healthy | ❌ No | ✅ Yes (Vitality program) |

| Tax Benefits | ✅ 80C, 10(10D) | ✅ 80C, 80D, 10(10D) |

| Best For | People who want only protection at cheapest cost | People who want protection + savings + health rewards |

Param Raksha Benefits

Accidental Death Cover

If your Sum Assured is ₹50 lakhs, and you die in a road accident → Family gets ₹50 lakhs.

👉 If accident occurs in public transport (bus/train/flight) → Family gets ₹1 crore (2X benefit)

Accidental Disability Cover

If you lose both legs in an accident (permanent disability), you still get the insurance payout, so you and your family can manage expenses.

👉 2X payout if it happened in public transport

Maturity Benefit (Wealth Creation)

At the end of the policy term, you get back your Fund Value + Top-up Value, based on market performance (like mutual fund growth).

Example: You paid ₹1 lakh/year for 20 years. At 8% growth, your maturity value could be around ₹45–50 lakhs.

Term Booster

If you are diagnosed with terminal illness, the Sum Assured is paid early → family gets money when they need it the most.

Tax Benefits

- Premiums paid are eligible for deduction under 80C & 80D

- Death benefit is tax-free under section 10(10D)

Extra Rewards

- Refund of Charges: Mortality charges refunded back as units from 11th year

- Loyalty Boosters: Extra units added after 10+ years if you stay invested

- Wellness Rewards: Discounts & cashbacks for staying fit

Also Read: Are You Looking For Best Savings Plan?

Conclusion

If your goal is only cheap life cover, a Term Plan is enough.

But if you want comprehensive protection + wealth creation + benefits for surviving, then Param Raksha Life Pro Plus is a smarter choice.

Source : TATA AIA Insurance

❓ Frequently Asked Questions (FAQs)

1. What is Param Raksha (Life Pro / Life Pro+)?

Param Raksha is a ULIP (Unit‑Linked Insurance Plan) by Tata AIA, combining life protection and investment. It offers market‑linked returns plus a life cover, along with optional benefits such as terminal illness, accidental death/disability, wellness incentives, etc.

2. Who is this plan suitable for?

Param Raksha is suited for people who want both protection (life cover, death/accident/disability) and wealth creation via market‑linked investments. If you are okay with risk, long time horizons, and need flexibility. If you prefer only pure insurance with minimal cost, pure term plans might be more appropriate.

3.What is the lock‑in period?

The ULIP has a lock‑in of 5 years. During this period, you can’t surrender or withdraw fully/partially without incurring penalties or losses.

4. What are the tax benefits?

- Premiums paid are eligible for tax deductions under Section 80C (depends on current tax laws).

- Payouts (death benefits, fund value on maturity) may also be tax‑exempt under Section 10(10D), subject to conditions.

5. What happens in case of death / accident / disability?

- In case of death, a lump sum sum assured is paid to your nominee.

- If affected by total & permanent disability, the benefit (often same or proportional to sum assured) will be paid. Some versions provide double benefit in case of accident in public transport.

- Terminal illness diagnosis often gives advance payout of part of sum assured.

6. What happens in case of death / accident / disability?

- In case of death, a lump sum sum assured is paid to your nominee.

- If affected by total & permanent disability, the benefit (often same or proportional to sum assured) will be paid. Some versions provide double benefit in case of accident in public transport.

- Terminal illness diagnosis often gives advance payout of part of sum assured.

1 thought on “Param Raksha(Complete Protection + Smart Savings Plan) Is The Best ULIP Plan In India”