Golden Rule of Investment

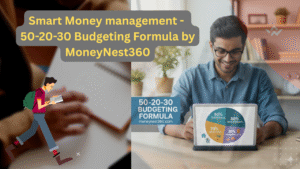

When it comes to financial planning, one golden principle stands out for everyone – no matter your income level, background, or lifestyle:

“Always invest at least 30% of your income.”

This rule may sound simple, but it is a powerful step toward building long-term wealth and securing your family’s future.

Why the 30% Rule Works

- Financial Discipline – By committing to invest a fixed portion of your income, you create a habit of saving and avoid overspending.

- Wealth Creation – Investments grow over time through compounding, giving you significant returns in the long run.

- Family Security – Allocating funds into insurance or safe investments ensures your loved ones are protected even during uncertainties.

- Future Goals – Be it retirement, buying a home, or children’s education, regular investments ensure you’re prepared.

How Different People Can Apply the 30% Rule

1. Salaried Employees (Regular Income)

- Example: If you earn ₹50,000 per month, invest ₹15,000.

- Best Options: SIPs in Mutual Funds, ULIPs, Retirement Plans.

2. Business Owners / Lump Sum Investors

- Example: If you have ₹20 lakhs in hand, allocate at least ₹6 lakhs to secure investments.

- Best Options: Real Estate, Fixed Deposits, Diversified Equity Funds.

3. Freelancers / Irregular Income Earners

- Example: If you earn ₹5 lakhs in a year, invest ₹1.5 lakhs.

- Best Options: Life Insurance, Recurring Deposits, Low-risk Mutual Funds.

Steps to Follow Before You Start Investing

1. If You Can’t Afford to Invest Yet, Don’t

It’s important not to start investing until you can truly afford to. First:

- Build an emergency fund with instant access.

- Clear debts and never invest using a credit card.

- Once your day-to-day money matters are in order, you can confidently begin investing.

2. Set Realistic Investment Expectations

- Higher returns usually come with higher risks.

- Decide how much risk you’re willing and able to take.

- Be wary of unrealistic promises—if it sounds too good to be true, it probably is.

- Consider charges and fees, as these can eat into returns over time.

3. Understand Your Investment

- Research thoroughly before investing.

- Know the level of risk, liquidity, and performance factors.

- Avoid rushing into investments you don’t fully understand.

- Check whether the provider is authorised and regulated.

4. Diversify Your Portfolio

- Don’t put all your eggs in one basket.

- Spread investments across companies, sectors, and regions.

- Consider managed funds to automatically diversify.

5. Take a Long-Term View

- Aim for at least 5 years or more to ride out market fluctuations.

- Avoid timing the market—focus on consistency.

- Regular monthly investing (SIPs) can smooth out volatility.

- Check liquidity options in case of emergencies.

6. Keep on Top of Your Investments

- Review performance regularly.

- Rebalance if certain investments outperform or underperform.

- Adjust according to changes in income, goals, or risk tolerance.

Tips to Follow the Golden Rule

- Automate your investments through SIP mandates.

- Diversify across equity, debt, real estate, and insurance.

- Review your investments annually to align with your goals.

- Avoid dipping into investments for short-term expenses.

Final Thoughts

The golden rule of investing—putting away at least 30% of your income—is not just about growing wealth. It’s about securing peace of mind, protecting your family, and building a strong financial future. By combining this rule with smart practices like clearing debts, diversifying, setting realistic goals, and reviewing regularly, you can make your money truly work for you.

💡 Start today. The earlier you invest, the stronger your future becomes.

Also Read: Smart Investment Choices: Amazing Money Growth Tips

4 thoughts on “The Golden Rule of Investment: Follow the 30% Rule + 6 Essential Steps”