On the eve of Navratri, Prime Minister Narendra Modi addressed the nation with some exciting news for every Indian household. He announced the launch of GST 2.0, calling it the start of a “Bachat Utsav” – a festival of savings!

But what exactly does this mean for you and your family? Let’s break it down in simple terms

1. GST 2.0: Simpler & Cheaper

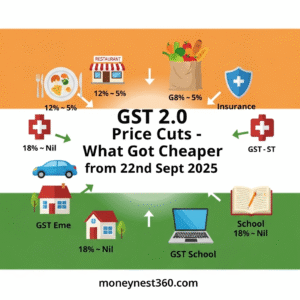

The Goods and Services Tax (GST), introduced in 2017, replaced a confusing web of multiple taxes. But even then, items were taxed at different rates: 5%, 12%, 18%, or 28%, making things a bit tricky.

Now, under GST 2.0:

- 5% tax will apply to most everyday items.

- 18% tax will apply to luxury and higher-end products.

- Items previously taxed at 12% or 28% have now mostly moved to lower rates.

Example:

- Your favorite chocolates, snacks, or daily groceries that were taxed at 12% will now cost less under the 5% rate.

- High-end cars or alcohol will still have a higher tax, but it’s more transparent.

This means more money in your pocket every time you shop.

Also Read: GST Reforms 2025(GST 2.0): Two-Slab Structure, Lower Taxes & Big Relief for Common Man

2. A “Double Bonanza” for the Middle Class

PM Modi linked GST 2.0 to the income tax relief announced earlier this year: people earning up to ₹12 lakh per year don’t have to pay income tax.

Combined with lower GST rates, this is a double benefit:

- Essentials like groceries, clothes, and electronics are cheaper.

- You keep more of your hard-earned money.

Example:

If you spend ₹5,000 a month on groceries, snacks, and household items, you might now save ₹200–300 every month just from the new GST rates. Add income tax relief, and your annual savings grow significantly.

Also Read: What Got Cheaper After GST 2.0? A Sector-Wise Breakdown with Tax Comparison

3. How GST 2.0 Helps Businesses & the Economy

Simplifying taxes isn’t just good for shoppers – it’s a boon for businesses too:

- Less confusion in tax filing.

- Easier transport of goods between states.

- Attracts new investments and promotes entrepreneurship.

Example:

A small shop in Pune selling products across Maharashtra will now face fewer taxes and paperwork, allowing them to grow faster and serve you better.

4. Swadeshi & Self-Reliance

Alongside GST reforms, PM Modi urged Indians to buy “Made in India” products. The goal is to make India self-reliant (Atmanirbhar-bharat) and boost domestic production.

Example:

- Instead of buying imported combs or gadgets, choose Indian brands.

- When more people buy Indian products, jobs are created and the economy grows.

5. What This Means for You

In simple terms, GST 2.0 and the government’s policies are designed to:

- Make daily essentials cheaper.

- Put more money in your hands.

- Encourage buying Indian products.

- Support businesses and create jobs.

Celebrating GST Bachat Utsav means enjoying these benefits while also being part of a bigger economic growth story.

So this Navratri, it’s not just about festivities – it’s about saving more, buying smarter, and supporting India’s growth!

Key Takeaways:

- Most everyday items now cost less under the new GST rates.

- Middle-class families enjoy a double benefit: lower taxes + lower prices.

- Supporting Indian-made products strengthens the economy.

- Businesses have a simpler tax system, boosting growth and jobs.

Your Turn: Next time you shop, check for GST savings and choose swadeshi products – small actions can lead to big changes!

Final Thoughts

The launch of GST 2.0 is not just a tax reform – it’s the beginning of a new savings era for every Indian family. From making essentials cheaper to giving the middle class a much-needed relief, this reform is designed to put more money in your hands.

At the same time, by choosing swadeshi products, we as citizens can turn these savings into strength for the nation. Every rupee saved and every Indian-made product purchased is a step towards an Atmanirbhar Bharat.

This Navratri, while we celebrate traditions, let’s also celebrate this “Bachat Utsav” – where our savings grow, our businesses thrive, and India’s growth story accelerates.

Choose savings, choose swadeshi, choose India’s brighter future.

Source: Central Board Of Indirect Taxes & Customs

Frequently Asked Questions(FAQs)

1. What is GST 2.0?

GST 2.0 is the new version of India’s Goods and Services Tax reform, announced by PM Modi. It simplifies the tax system into just two main rates – 5% and 18%, making most goods cheaper and easy to buy.

2. How does GST 2.0 save me money?

With GST 2.0, many products that were earlier taxed at 12% or 28% have now been shifted to lower tax brackets. This means the prices of your daily groceries, clothes, and other essentials will drop, giving you more savings.

Example: If you bought items worth ₹1,000 earlier at 12% GST, you paid ₹120 tax. Now at 5%, you’ll pay only ₹50 – a saving of ₹70!

3. What is “Bachat Utsav”?

“Bachat Utsav” means Festival of Savings. Starting from Navratri 2025, the government is calling this phase of GST reform a celebration because it directly increases household savings across India.

4. Who benefits from GST 2.0?

- Common people – cheaper essentials and more savings.

- Middle class – a “double bonanza” with both income tax relief and GST savings.

- Businesses – simpler taxes, easier trade between states.

- Nation – more investments, growth, and jobs.

5. Are luxury goods still taxed high?

Yes. Luxury items and sin goods (like alcohol and tobacco) will still have an extra compensation cess of up to 40%. The government wants essentials cheaper but luxury items fairly taxed.

6. How does GST 2.0 connect with Swadeshi and Atmanirbhar Bharat?

PM Modi encouraged citizens to buy Made in India products. The idea is simple:

- GST savings put more money in your hand.

- If you spend that money on Indian products, you support local businesses and create jobs, strengthening Atmanirbhar Bharat.

7. From when is GST 2.0 applicable?

The new GST 2.0 rates will be effective from 22nd September 2025, the first day of Navratri.