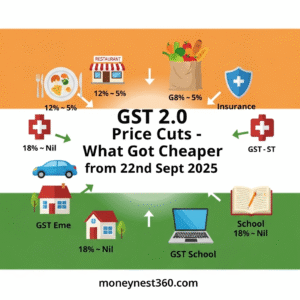

The Government of India has made a big move to make insurance cheaper and more accessible. Starting September 22, 2025, GST on life insurance and health insurance premiums has been reduced from 18% to 0% (nil).

Earlier, whenever you paid a premium for term insurance, health cover, ULIPs, or retirement plans, an extra 18% tax was added. Now, that tax is completely removed. This means insurance premiums are directly cheaper for everyone.

Let’s understand this with simple examples that any Indian family can relate to.

How Insurance Became Cheaper After GST 2.0

1. Term Insurance (Protecting Your Family)

👉 Before GST 2.0:

If Randy, a salaried employee in Delhi, bought a term plan with a premium of ₹20,000, he had to pay ₹3,600 extra as GST.

So, he paid ₹23,600.

👉 After GST 2.0:

Now, Rajesh only pays ₹20,000 – saving ₹3,600 every year.

💡 Why it matters: Term plans are already affordable, and with GST gone, even middle-income families can now secure ₹1 crore cover at a very low cost.

Also Read: Top 10 Term Insurance Plans in India 2025 -Smart Wealth & Protection in One | MoneyNest360.com

2. Health Insurance (Protecting Against Medical Bills)

👉 Before GST 2.0:

Sheelu, a mother of two in Lucknow, paid ₹25,000 for her family floater health insurance. With 18% GST, the actual cost was ₹29,500.

👉 After GST 2.0:

Now, the same policy costs only ₹25,000 – saving her ₹4,500 annually.

💡 Why it matters: With rising hospital bills, this reform makes health insurance more affordable for families, especially senior citizens and middle-class households.

3. ULIPs (Insurance + Investment)

👉 Before GST 2.0:

A young IT professional, Arun Nair, invested ₹1,00,000 in a ULIP (insurance + market-linked investment). He had to pay ₹1,18,000 including GST.

👉 After GST 2.0:

Now, he invests exactly ₹1,00,000. That’s ₹18,000 saved, and more of his money goes into actual investment.

💡 Why it matters: For long-term savings, this small difference compounds into lakhs of rupees over 15–20 years.

4. Child Plans (Securing a Child’s Education)

👉 Before GST 2.0:

Priyanshi, a school teacher, invested ₹40,000 yearly in a child education plan. With GST, she paid ₹47,200.

👉 After GST 2.0:

Now, she pays only ₹40,000. That’s ₹7,200 saved every year.

💡 Why it matters: Parents can now build a bigger fund for their children’s higher education or marriage without extra tax.

5. Retirement / Pension Plans (Planning Old Age)

👉 Before GST 2.0:

Suyansh, a small shop owner, contributed ₹3,000/month in a pension plan = ₹36,000/year. With GST, it became ₹42,480.

👉 After GST 2.0:

Now, he pays exactly ₹36,000. He saves ₹6,480 annually, which can be redirected into his retirement corpus.

💡 Why it matters: Pension plans are long-term – these annual savings add up big time for a secure retirement.

A Common Man’s Family Example:

Imagine Ravi, a middle-class father of two in Hyderabad. He pays for:

- Term Insurance: ₹12,000/year

- Health Insurance (family floater): ₹25,000/year

- Child Plan: ₹40,000/year

👉 Before GST 2.0 (18% tax):

- Term: ₹14,160

- Health: ₹29,500

- Child Plan: ₹47,200

Total = ₹90,860

👉 After GST 2.0 (0% tax):

- Term: ₹12,000

- Health: ₹25,000

- Child Plan: ₹40,000

Total = ₹77,000

✅ Ravi saves ₹13,860 every year!

That’s enough to pay a child’s school fees, household bills, or even buy extra coverage.

Benefits for You and Your Family After GST 2.0

- Cheaper Premiums: You pay only for coverage, not extra tax.

- More People Can Afford Insurance: Even small shopkeepers, farmers, or daily wage earners can now think of getting insurance.

- Extra Savings Every Year: The tax-free amount can be reinvested or used for family needs.

- Encourages First-Time Buyers: Families who avoided insurance due to high cost can now enter the safety net.

Will GST 2.0 Impact Base Premiums of Insurance Policies?

When we talk about insurance premiums, there are two parts:

- Base Premium → The actual cost of insurance as determined by the insurer. This depends on age, health, sum assured, policy term, etc.

- GST (earlier 18%) → A tax component added on top of the base premium.

✅ What Changes with GST 2.0?

- Before GST 2.0: Customers paid Base Premium + 18% GST.

- After GST 2.0: Customers pay Base Premium only (GST is nil).

👉 The base premium itself is not directly reduced by GST 2.0, since it is calculated by insurers based on risk and product features.

👉 What changes is that the extra tax layer (18%) is removed, which brings down the final payable premium.

But Will Insurers Adjust Base Premiums?

This is where it gets interesting:

- Loss of Input Tax Credit (ITC):

Under GST, insurers could claim credit for GST paid on commissions, IT expenses, vendor services, etc. With GST at 0% on premiums, they can no longer claim these credits.

👉 This increases insurers’ operational costs. - Possible Premium Adjustments:

To balance these costs, insurers may slightly increase base premiums (by 3–5%) in the future.

Example: If your base premium was ₹10,000, insurers may revise it to ₹10,300–₹10,500.

Net Effect for Customers

Even if insurers increase base premiums a little, customers still benefit because:

- Earlier: ₹10,000 base + ₹1,800 GST = ₹11,800 payable.

- Now (if insurer hikes base 5%): ₹10,500 base + ₹0 GST = ₹10,500 payable.

👉 Customer still saves ₹1,300 (about 11%) compared to the old system.

Long-Term Outlook

- Short term (2025–26): Customers enjoy direct 18% reduction.

- Medium term (next 1–2 years): Insurers may tweak base premiums slightly upward due to loss of ITC.

- Long term: With more people buying insurance (thanks to affordability), higher volumes may balance costs, reducing pressure to hike base premiums significantly.

Simple Example for Common People

Imagine you are buying a Health Insurance Plan for your family:

- Old system: Base premium ₹25,000 + GST (₹4,500) = ₹29,500.

- New system (without GST): ₹25,000 only.

- If insurer raises base premium by 5% later: ₹26,250.

Even in worst case, you still save ₹3,250 compared to earlier.

Source: Central Board Of Indirect Taxes & Customs

Final Thoughts

- For Indian households, this reform makes protection, health security, and financial planning more accessible, encouraging long-term wealth and security planning.

- GST 2.0 is a win-win for customers, as it directly reduces the cost of buying and renewing insurance policies.

- While insurers may slightly increase base premiums in the medium term due to operational pressures, customers will still save 10–15% overall compared to the pre-GST regime.

This is a huge step toward the government’s vision of “Insurance for All by 2047” and a big relief for common people.

Frequently Asked Questions(FAQs)

1. Is GST removed on all insurance policies?

Yes. Under GST 2.0 (effective 22nd September 2025), the government has reduced GST on individual life insurance and health insurance policies from 18% to 0%. This includes term plans, ULIPs, child plans, retirement/pension plans, savings plans, and health insurance.

2. Will my insurance premium reduce after GST 2.0?

Yes, your payable premium will reduce immediately because the 18% GST is no longer added.

3. Does GST 2.0 impact the base premium of insurance?

- Directly → No (the base premium charged by the insurer remains the same initially).

- Indirectly → Yes (since insurers lose GST Input Tax Credit, they may slightly increase base premiums in the future, around 3–5%).

4. Will insurers increase premiums because of GST 2.0?

Possibly. Since insurers cannot claim input tax credit now, they may revise base premiums upward slightly in the future. But even after such an increase, the net payable premium will remain lower compared to when GST was 18%

5. What about tax benefits on insurance after GST 2.0?

There is no change in tax benefits. You can still claim deductions:

- Section 80C → Up to ₹1.5 lakh for life insurance premiums.

- Section 80D → For health insurance premiums (up to ₹25,000, and ₹50,000 for senior citizens).

- Section 10(10D) → Death benefit payouts remain tax-free.

6. What about tax benefits on insurance after GST 2.0?

There is no change in tax benefits. You can still claim deductions:

- Section 80C → Up to ₹1.5 lakh for life insurance premiums.

- Section 80D → For health insurance premiums (up to ₹25,000, and ₹50,000 for senior citizens).

- Section 10(10D) → Death benefit payouts remain tax-free.

7. Will old policies also get the GST benefit?

Yes. At your next renewal, premiums will be recalculated without GST. So both new and existing policyholders benefit from GST 2.0.