GST Reforms 2025(GST 2.0):

Introduction:

Since its launch on 1st July 2017, the Goods and Services Tax (GST) has been India’s biggest indirect tax reform. By replacing multiple central and state taxes with a single unified system, GST created a common national market, reduced double taxation, and made compliance easier. Over the years, GST has evolved through digital innovations and rate rationalization, becoming the backbone of India’s indirect tax system.

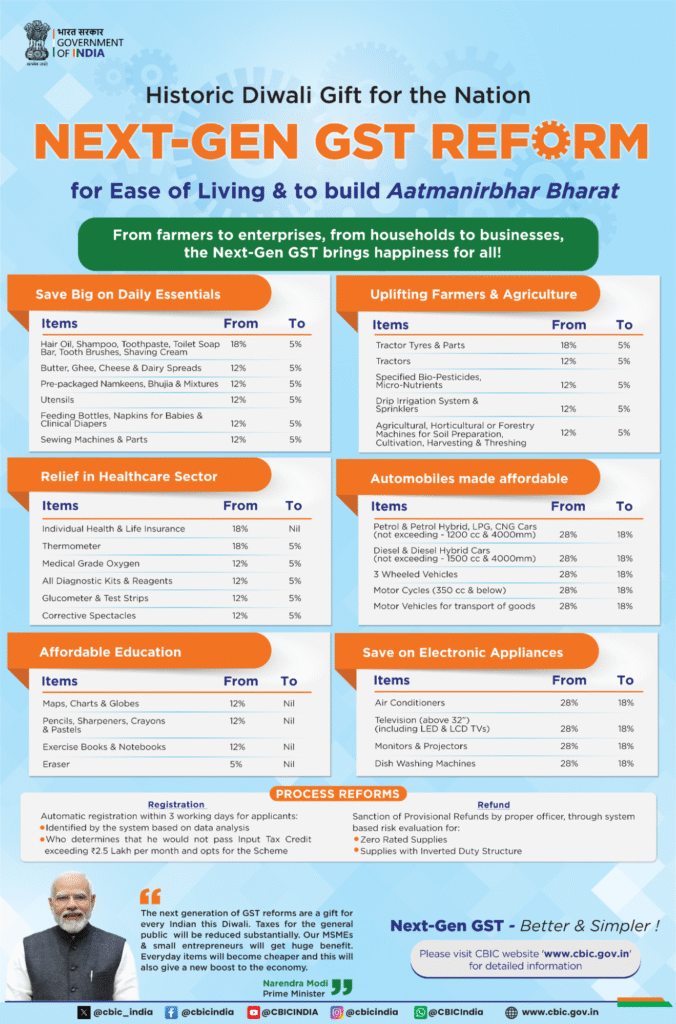

Now, the 56th GST Council meeting, chaired by Union Finance Minister Smt. Nirmala Sitharaman, has approved a major set of Next-Gen GST Reforms. These changes are aimed at:

- Reducing tax burden on the common man

- Supporting MSMEs and businesses

- Boosting manufacturing, farming, and exports

- Simplifying compliance for traders

Prime Minister Narendra Modi had called these reforms a “Diwali gift” for citizens—directly benefiting farmers, MSMEs, women, youth, and middle-class families, while driving India’s long-term growth.

Highlights of GST Reforms 2025:

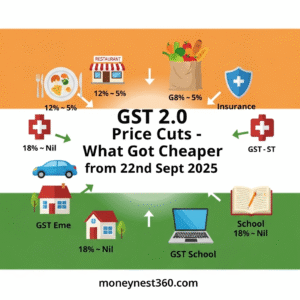

✔️ Simplified two-slab GST structure (5% & 18%)

✔️ Essential household items like soaps, toothpaste, and breads moved to 5% or Nil

✔️ Life-saving medicines reduced to Nil or 5%, making healthcare more affordable

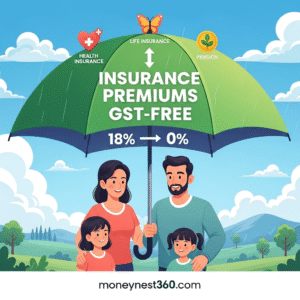

✔️ Life & Health insurance premiums GST Exempted, Reduced to Nil

✔️ Two-wheelers, small cars, TVs, ACs, and cement cut from 28% to 18%

✔️ Farm machinery & irrigation equipment reduced from 12% to 5%

✔️ Luxury & sin goods (tobacco, pan masala, aerated drinks, high-end cars, yachts, etc.) taxed at 40%

Key Takeaways(GST 2.0):

The reforms are built around 7 pillars of Next-Gen GST:

- Simplified two-slab structure (5% & 18%)

- Lower tax on essentials to ease cost of living

- Faster refunds & easier compliance for businesses

- Relief for MSMEs & startups by reducing costs

- Correcting inverted duty structures in sectors like textiles and fertilizers

- Boost to consumption & demand through lower prices

- Fair taxation with higher taxes only on luxury/sin goods

All revised rates will take effect from 22nd September 2025, except on products like cigarettes, beedis, and chewing tobacco (which will continue under the old rates until pending cess loans are cleared).

Sector-Wise Impact of Reforms

🏠 Household & Food

- Nil GST: UHT milk, paneer, Indian breads

- 5% GST: soaps, shampoos, toothbrushes, toothpaste, bicycles, tableware

- Packaged foods: chocolates, sauces, pasta, preserved meat reduced from 12%/18% → 5%

- Consumer durables: TVs (>32”), ACs, dishwashers cut from 28% → 18%

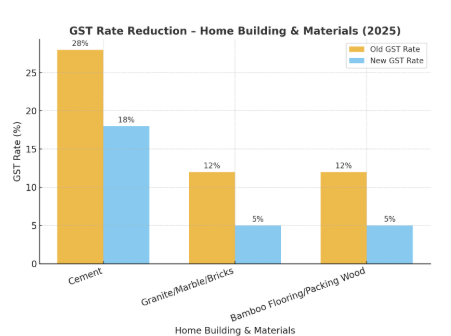

🏗️ Home Building & Materials

- Cement: 28% → 18%

- Granite, marble blocks, sand-lime bricks: 12% → 5%

- Bamboo flooring, packing wood: 12% → 5%

This will lower housing costs and boost real estate demand

🚗 Automobile Sector

- Small cars, two-wheelers (≤350cc): 28% → 18%

- Buses, trucks, three-wheelers, auto parts: 28% → 18%

Expected to increase sales and exports

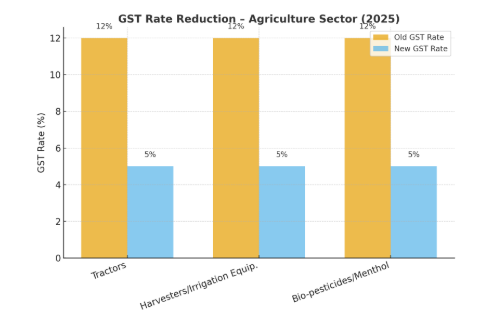

🌾 Agriculture

- Tractors: 12% → 5%

- Harvesters, threshers, sprinklers, drip irrigation: 12% → 5%

- Bio-pesticides & natural menthol: 12% → 5%

Lower costs for farmers and push for sustainable agriculture

🏨 Service Industry

- Hotels (up to ₹7,500/day): 12% → 5%

- Gyms, salons, barbers, yoga services: 18% → 5%

👉 Boost to tourism and wellness sector.

🎭 Toys, Sports & Handicrafts

- Handicraft idols, statues, paintings, toys: 12% → 5%

- Manmade fibres: 18% → 5%

- Manmade yarn: 12% → 5%

- 👉 Support for artisans and export competitiveness

📚 Education Sector

- Exercise books, pencils, erasers, crayons, sharpeners: 0%

- Geometry boxes, school supplies: 12% → 5%

- 👉 Reduced burden on families, affordable education supplies

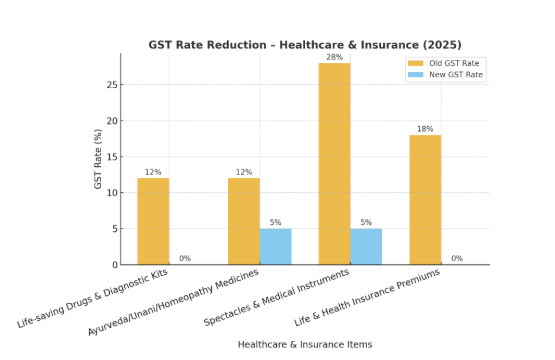

🏥 Medical & Insurance

- Life-saving drugs & diagnostic kits: 12% → 0%

- Ayurveda, Unani, Homoeopathy medicines: 12% → 5%

- Spectacles, medical instruments: up to 28% → 5%

- Life & Health insurance premiums: GST Exempted

Contact for More Info about Insurance Products:

Why These Reforms Matter

🔹 Lower Prices → Higher Consumption: More savings for households

🔹 MSME Support: Lower input costs boost competitiveness

🔹 Simplified Compliance: Two-rate system reduces disputes

🔹 Boost to Manufacturing & Exports: Corrected duty structures

🔹 Revenue Growth: Lower rates, higher compliance = bigger tax base

🔹 Social Protection: Insurance & medicine exemptions strengthen security

GST Journey: From 2017 to 2025

- Pre-GST: Multiple taxes, higher costs, compliance confusion

- 2017 Launch: Unified tax across India with 17 taxes + 13 cesses merged

- Now in 2025: 1.51 crore taxpayers, ₹22.08 lakh crore annual GST revenue, monthly average collections ₹2.04 lakh crore

👉 GST has doubled collections in just four years (CAGR 18%), reflecting strong compliance and economic momentum

Conclusion

The Next-Gen GST Reforms 2025 are more than just tax changes—they are a blueprint for inclusive growth. By cutting rates on essentials, boosting MSMEs, making compliance simpler, and ensuring fairness in taxation, India has taken a big step towards:

- Ease of Living for citizens

- Ease of Doing Business for enterprises

- Sustainable economic growth

From 22nd September 2025, these reforms will reshape India’s tax ecosystem, reaffirming GST’s role as a catalyst for prosperity and transformation.

References:

Central Board Of Indirect Taxes & Customs

Contact Us for More Information About Where to Invest and How to Invest