Withdraw Your PF Amount (Provident Fund) Online

Withdrawing your Provident Fund (PF) is now very easy, and you can do it online through the EPF Member Portal. Whether you need money for an emergency, a big life event like marriage or education, or you are retiring, your PF savings can help you in such situations.

In this guide, we will explain the complete process of withdrawing PF online. You will also understand who is eligible, for what reasons you can withdraw, how to apply for withdrawal, and other important details. Let’s get started!

Step 1: Login to the EPF Member Portal

The first step to withdrawing your Provident Fund is logging into the EPF Member Portal. Here’s how you can do it:

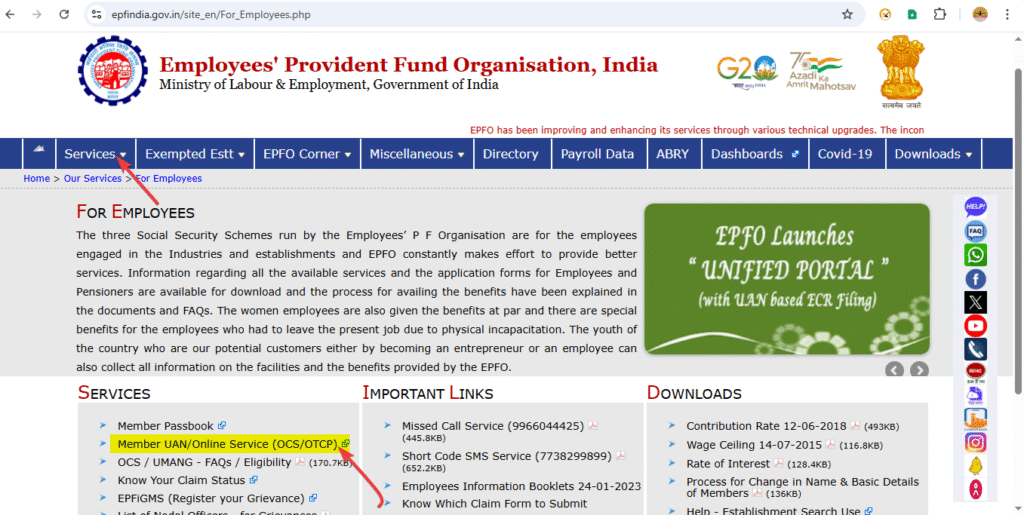

- Visit the EPF Portal: Go to the official EPF website at https://www.epfindia.gov.in.

- Click on ” Services” From the homepage and select “For Employees”

- Under “Services” Section click on “Member UAN/Online Services (OCS/OTCP)” or Click on this link you will redirect EPFO login page: EPFO Login Page

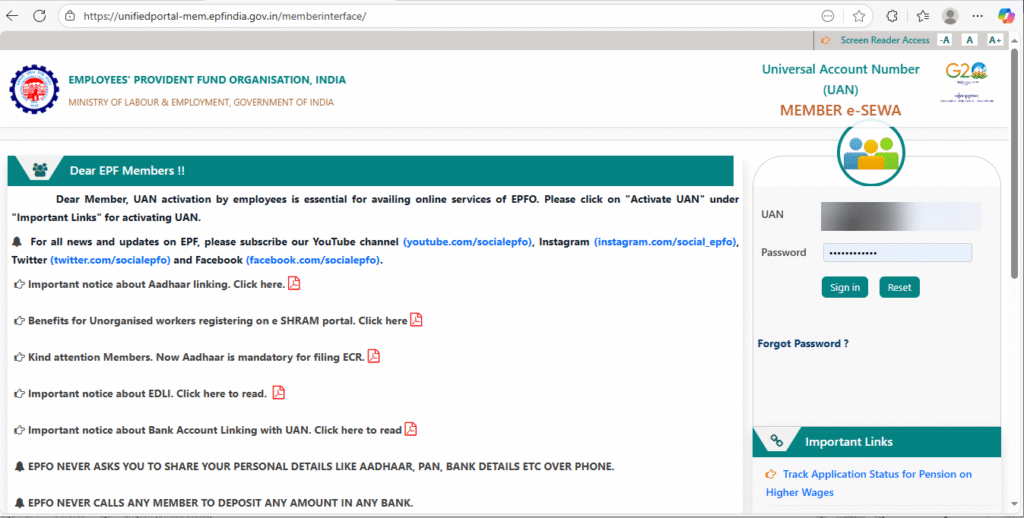

- Enter Your UAN and Password: You’ll need to log in with your UAN (Universal Account Number) and password.

Note:

Before withdrawing PF online, make sure of these two things:

- Your PF account must be linked with your registered mobile number.

- Your UAN (Universal Account Number) should be activated.

Without these, you cannot proceed with the online withdrawal process.

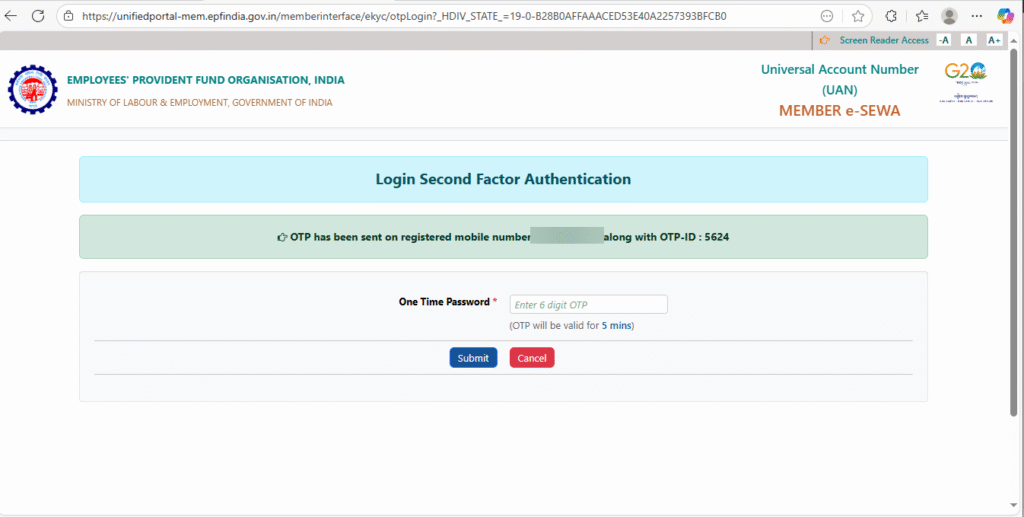

Step 2: OTP Verification

After entering your UAN and password, the portal will prompt you for OTP verification.

- You will receive an OTP on the mobile number that is linked with your EPF account.

- Enter the OTP in the required field and click Submit to proceed

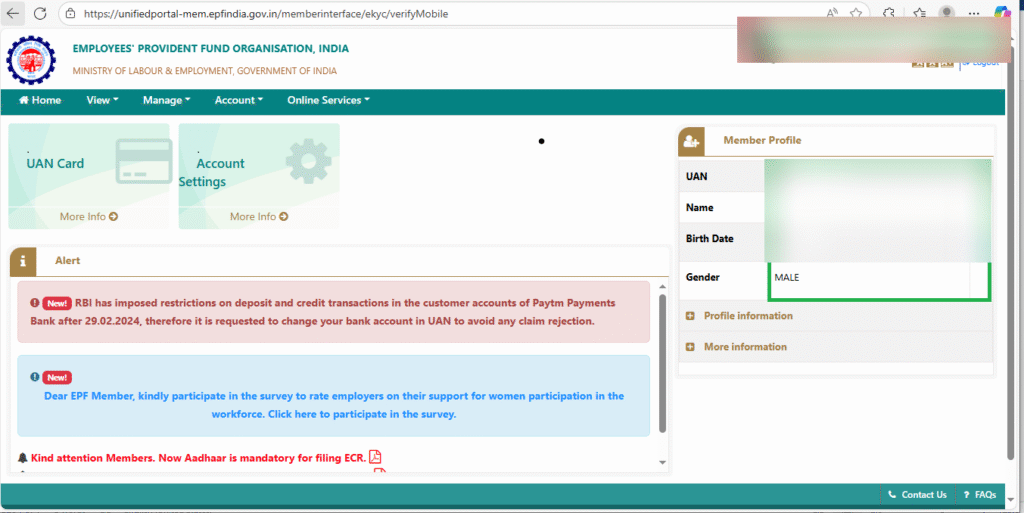

Step 3: Check Member Details & Profile Information

After you log in, you will reach the homepage. Here you can see your Member Details and Profile Information. This step is very important because your information should be correct and updated. Please check these points carefully:

- Aadhaar Number – Make sure your Aadhaar is linked with your PF account.

- PAN Details – If needed, check that your PAN is updated. This helps you avoid extra TDS (tax) deductions.

- Mobile Number – Confirm that your mobile number is correct, because OTPs will come to this number.

- Bank Details – Re-check your bank account number and IFSC code, so that money can be transferred without any problem.

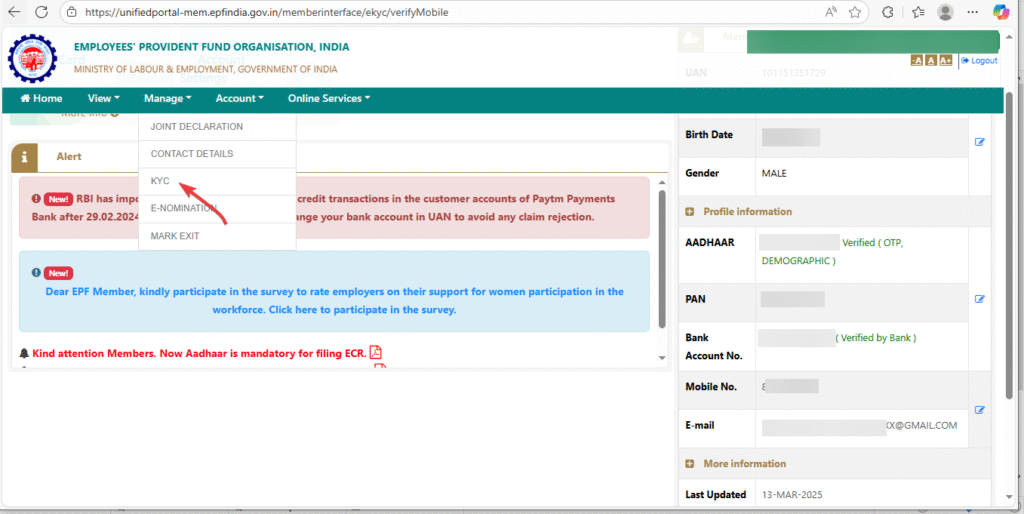

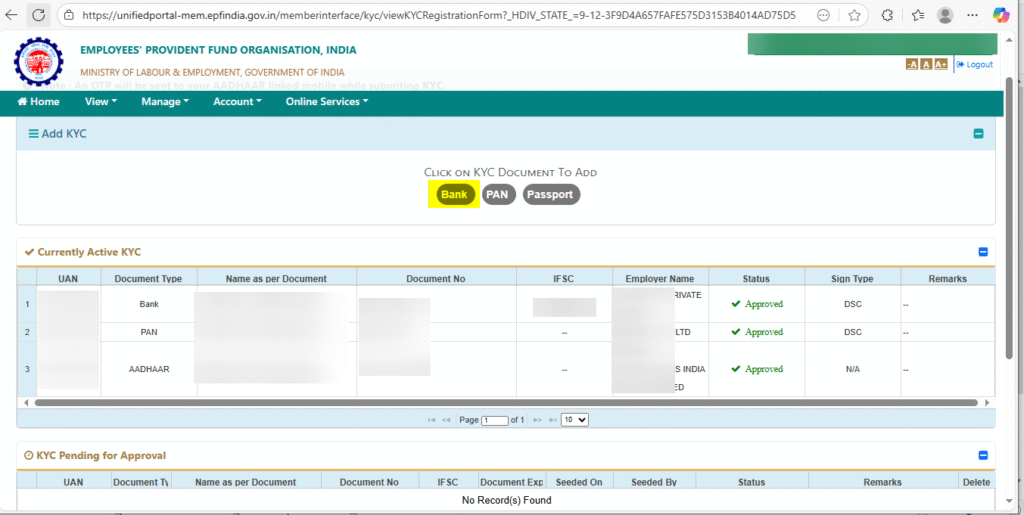

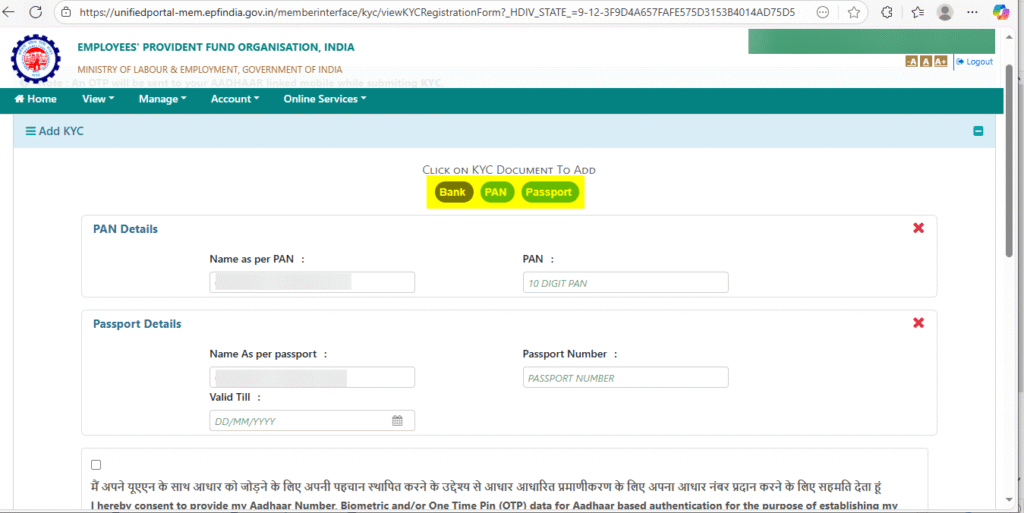

Step 4: Update KYC Details (If Needed)

Before you apply for PF Amount withdrawal, check that your KYC (Know Your Customer) details are updated. This will save you from delays and problems later.

- Bank Details – Add or update your bank account details if they are not linked already.

- PAN Number – Make sure your PAN is linked to your PF account. This is needed for tax purposes.

- Aadhaar – Ensure your Aadhaar is updated in the system. This helps in smooth OTP and identity verification.

👉 If your KYC details are correct, your PF money will come faster without any issues.

Also Read: Why Life Insurance Is the Smartest Way to Create Wealth and Protect Your Family?

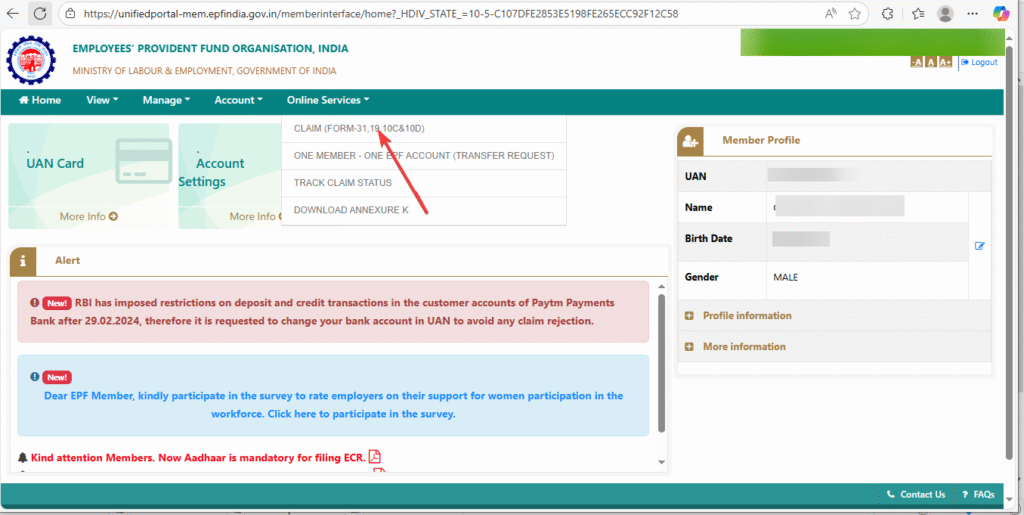

Step 5: Select the Claim Process (Form 31) and Submit Claim

How to Submit Your PF Withdrawal Claim Online

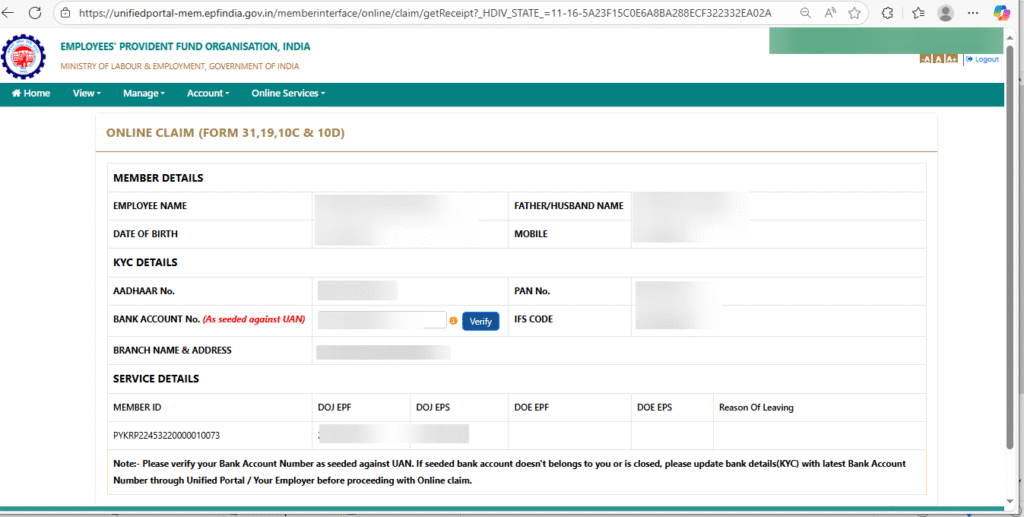

- Once your KYC details (Aadhaar, PAN, Bank details) are updated or confirmed in the KYC section, go to the top menu and click on “Online Services.”

- Select “Claim (Form 31, 19, 10C & 10D)” from the dropdown.

- A claim form will open with your details. Here, check and confirm the following:

- Member Details – Employee name, Father’s name, Date of Birth, Mobile number (all fields will be pre-filled).

- KYC Details – Aadhaar and PAN (auto-filled).

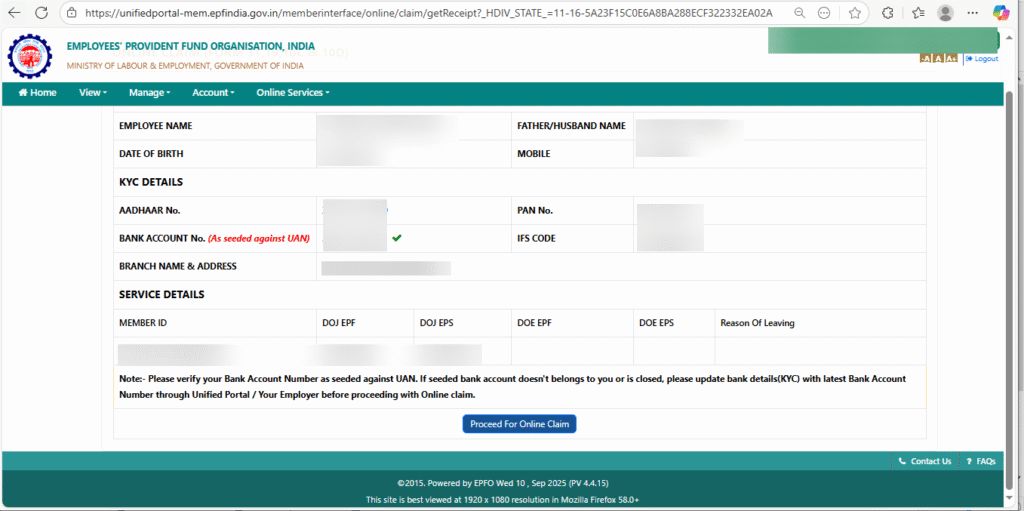

- Bank Details – Enter and verify your bank account number and IFSC code. Make sure it is correct.

- Service Details – Check your employment/service information.

- After verifying everything, click on “Proceed for Online Claim.”

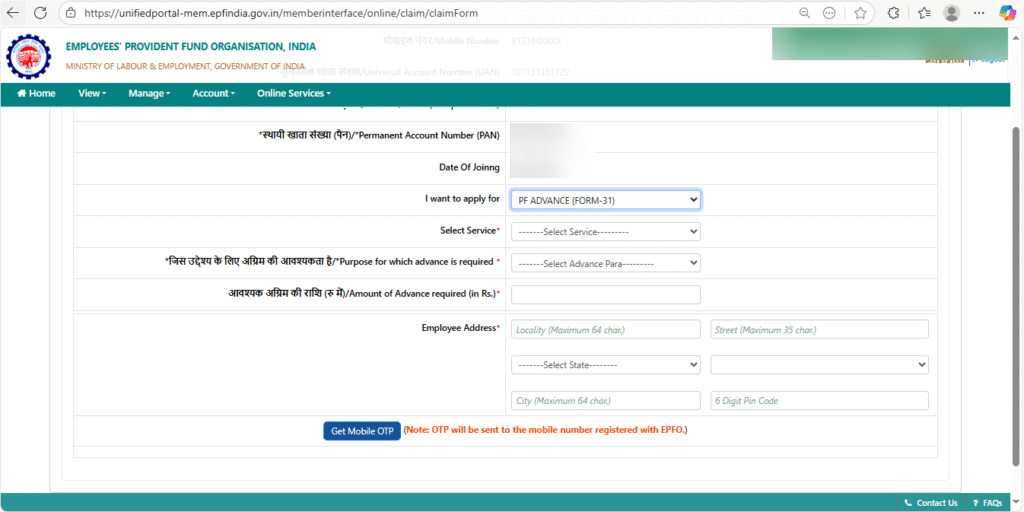

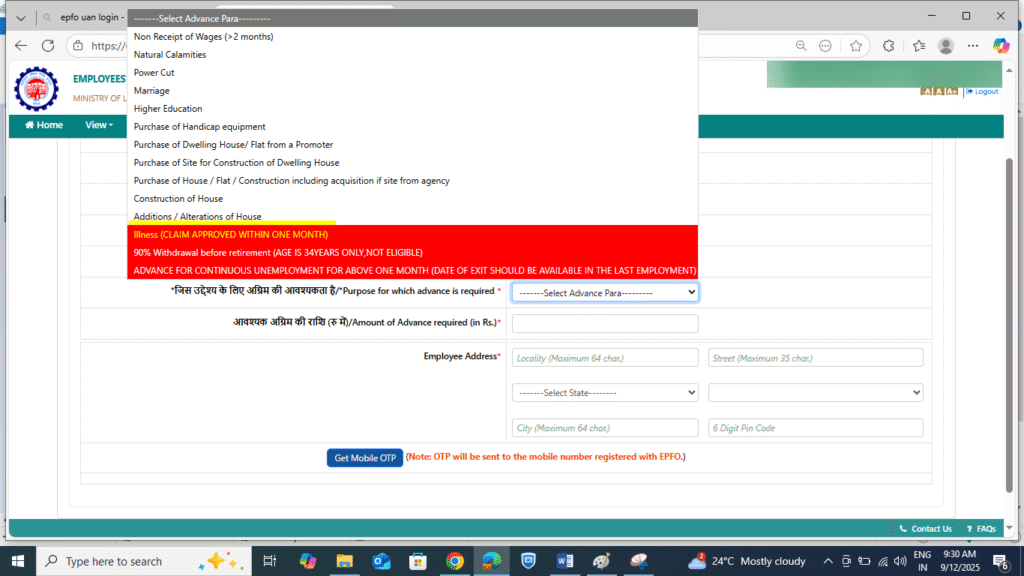

- In the dropdown under “I Want to Apply For”, select “PF Advance (Form 31).”

- If you have worked in multiple companies (with the same UAN), you will see a list. Select the company from which you want to withdraw PF under “Select Service.”

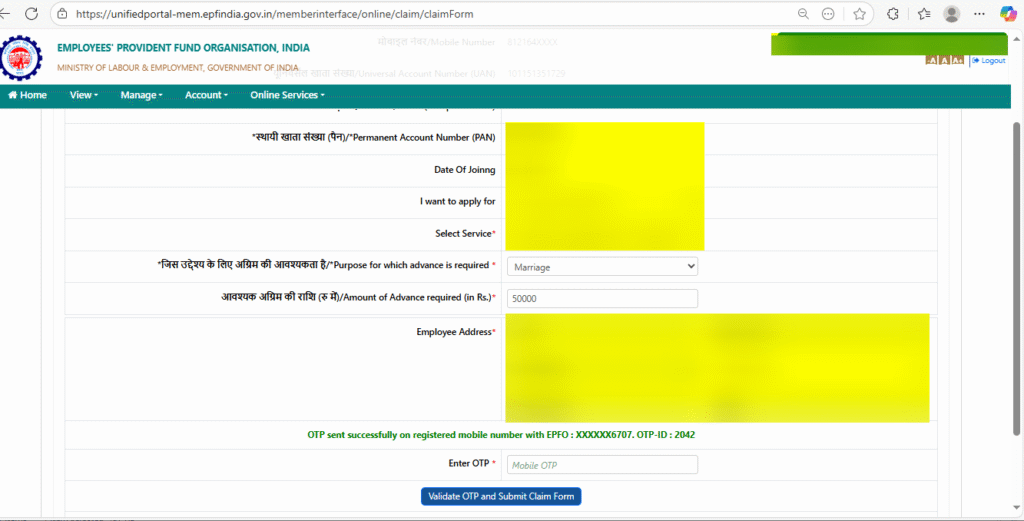

- Next, choose the reason for PF Amount withdrawal (like illness, marriage, higher education, house purchase, etc.) from the available list.

- Enter the withdrawal amount you require.

- Fill in your complete address in the “Employee Address” section.

- Click on “Generate OTP.” You will receive an OTP on your registered mobile number linked with Aadhaar.

- Enter the OTP correctly and click on “Validate.”

- Finally, click on “Submit Claim.”

Choosing the Right Reason for PF Amount Withdrawal

selecting why you want to withdraw your PF. For this, you need to file Form 31. But before applying, check whether you are eligible under any of these reasons:

List of PF Amount Withdrawal Options

- Non-Receipt of Wages

- Who can apply: If you have not received salary for 2 months or more.

- PF Amount you can withdraw: Full PF balance.

- Waiting time: No waiting, you can apply immediately.

- Illness

- Who can apply: If you or your family member needs medical treatment.

- PF Amount you can withdraw: Up to 6 months’ basic salary + DA.

- Waiting time: Immediate.

- Natural Calamities (like floods, earthquake, etc.)

- Who can apply: If you are affected by a natural disaster.

- PF Amount you can withdraw: Full PF balance.

- Waiting time: Processed immediately after verification.

- Power Cut (long duration)

- Who can apply: If your work is badly affected due to extended power cut.

- PF Amount you can withdraw: Up to 75% of PF balance.

- Waiting time: Around 1–2 weeks.

- Marriage

- Who can apply: For your own marriage or a family member’s marriage.

- PF Amount you can withdraw: Up to 50% of PF balance.

- Waiting time: You can apply 3 months before the marriage.

- Higher Education

- Who can apply: For your own or your children’s higher studies.

- PF Amount you can withdraw: Up to 50% of PF balance.

- Waiting time: Up to 3 months before course starts.

- Purchase of Handicap Equipment

- Who can apply: If you need to buy special equipment due to disability.

- Amount you can withdraw: Up to 50% of PF balance.

- Waiting time: Immediate, after verification.

- Purchase of Dwelling House

- Who can apply: To buy a plot/house.

- Amount you can withdraw: Up to 90% of PF balance.

- Waiting time: You must complete minimum 5 years of service.

- Purchase of House/Flat

- Who can apply: To buy a house or flat.

- Amount you can withdraw: Up to 90% of PF balance.

- Waiting time: 5 years of service required.

- Construction of House

- Who can apply: To construct a house.

- Amount you can withdraw: Up to 90% of PF balance.

- Waiting time: 5 years of service required.

- 90% Withdrawal Before Retirement

- Who can apply: If you are above 54 years and near retirement.

- Amount you can withdraw: Up to 90% of PF balance.

- Waiting time: Immediate.

- Advance for Continuous Unemployment

- Who can apply: If you are unemployed for more than 2 months.

- Amount you can withdraw: Full PF balance.

- Waiting time: After completing 2 months of unemployment.

👉 This way, people can clearly understand which reason fits them, how much they can withdraw, and when they can get it.

When you apply for withdrawal, select the correct purpose of advance as per your eligibility from the above list. This will help in a smooth and hassle-free PF withdrawal process.

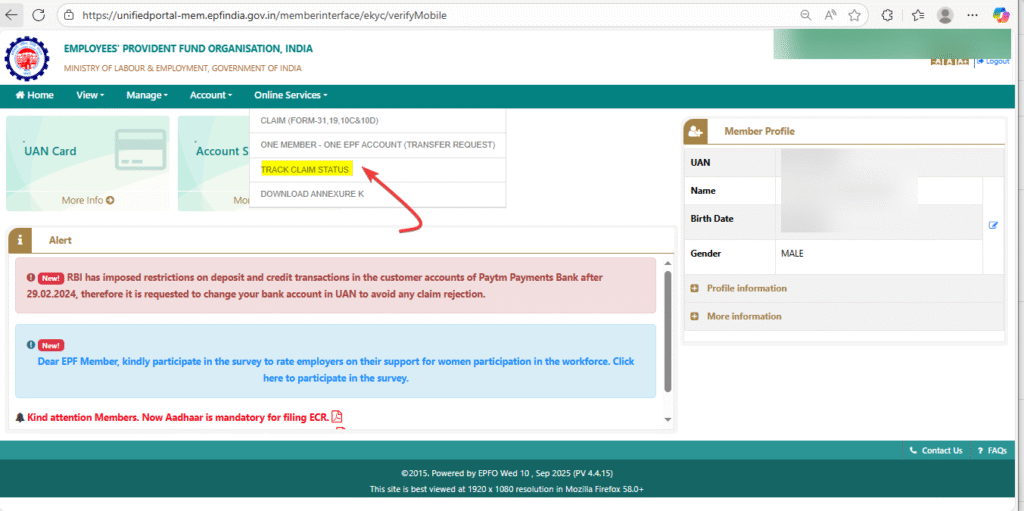

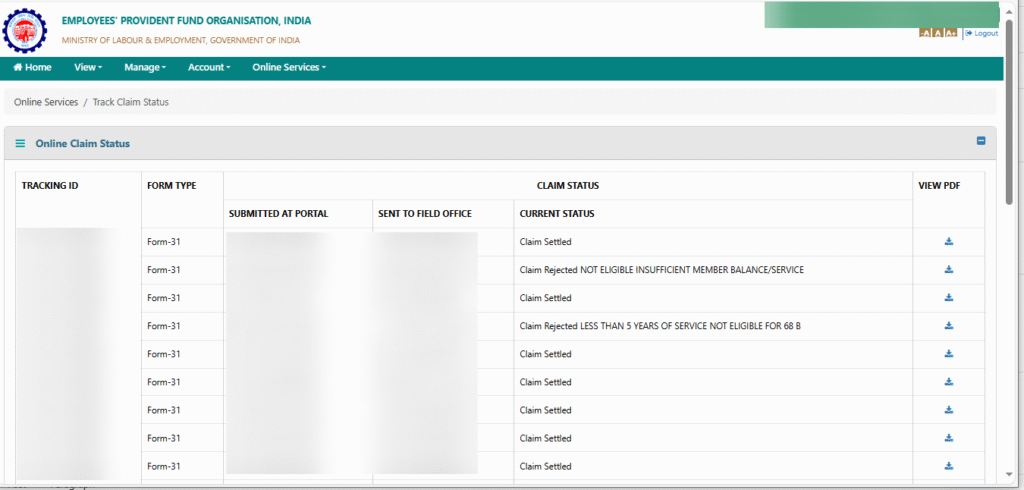

6.Track Claim Status

To know the status of your PF withdrawal, you need to visit the EPFO Portal regularly.

- Login to the portal.

- Click on “Online Services”

- Select “Track Claim Status”

Here, you can see whether your claim is in process, settled or rejected.

- Normally, PF claims are settled depending on the reason for withdrawal.

- Nowadays, some claims are processed automatically. For example, if the reason is illness, your claim may be settled in just 3 working days.

- In most other cases, PF claims are settled within 14 to 30 days.

Also Read: What Is the Smartest & Most Effective Way to Plan Your Finances for Life & Future Security?

7.Conclusion

Withdrawing your Provident Fund (PF) online is very simple if you follow the steps one by one. Always make sure your details are correct and updated, select the right reason for withdrawal, and complete the claim form carefully for a smooth process.

If your Aadhaar, PAN, and bank details are updated, your money will come directly to your bank account without any delay or problem.

Whether you need money for a personal emergency, higher education, marriage, or to buy a house, your PF savings can give you strong financial support at the right time.

Got Questions? Let’s Connect!

If you are confused about any step in the PF withdrawal process or facing any issues, don’t worry — we are here to help.

👉 Whether it’s about eligibility, claim submission, or understanding how EPF works, feel free to ask your questions in the comments below. We’ll be happy to guide you.

Good Info