Smartest Way to Plan Your Finances for Life & Future Security

As a Financial Advisor it is my Duty and Responsibility to help you to stay on right path to meet your and your family’s Financial Goals.

Managing finances isn’t just about numbers, it’s about balancing responsibilities, protecting your family, and planning for the future. Let’s explore some key aspects of financial planning that every individual and family should understand.

Duty v/s Responsibility

Duty means whether you are doing a job, running a business, doing farming, or even working as a daily laborer. the money you earn is mainly for taking care of your family’s daily needs. That includes paying bills, children’s education, parents’ needs, and your own requirements.

Responsibility means planning for the future. If something happens to us, our children’s education, their daily needs, their future, even their marriage — everything should go smoothly without any problem. The same applies to our parents or spouse who depend on us. Even if we are not there, they should not suffer. This is why we should save money and plan properly.

In today’s generation, most of us don’t want to struggle beyond 50 years of age. After that, we wish to live peacefully. That’s why it’s important to plan for retirement, not only for ourselves but also for our spouse’s and children security.

Also Read: The Golden Rule of Investment: Follow the 30% Rule + 6 Essential Steps

Life v/s Money

Some people may give more importance to life itself, but I believe that without money, life cannot be lived properly.

From childhood to old age, in one way or another, we always depend on someone.

In childhood, we depend on our father/mother.

In old age, we depend on our children.

In youth, we depend on ourselves.

If the earning person stops earning or is not there, then the lives of the people depending on him or her will become a big question mark. That is why it is very important to do proper savings and investments for the future.

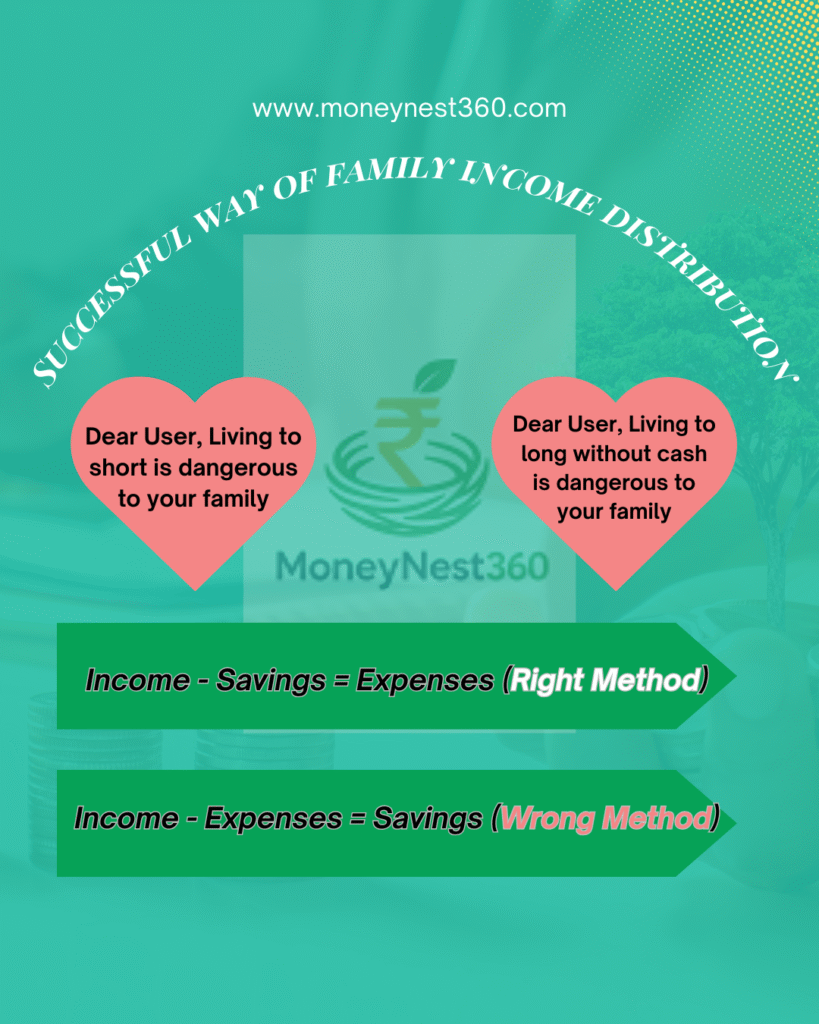

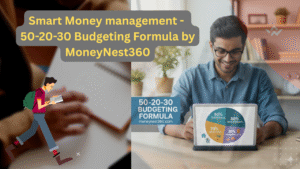

Successful Way Of Family Income Distribution

Most of us spend money on our daily needs and then try to save whatever is left. But that method rarely works because expenses never end.

The smarter way is this: first save, then spend.

From every income, keep aside a fixed amount for savings or investment, and then use the balance for expenses. This habit will help you build wealth, secure your children’s future, and live a peaceful retired life without depending on anyone

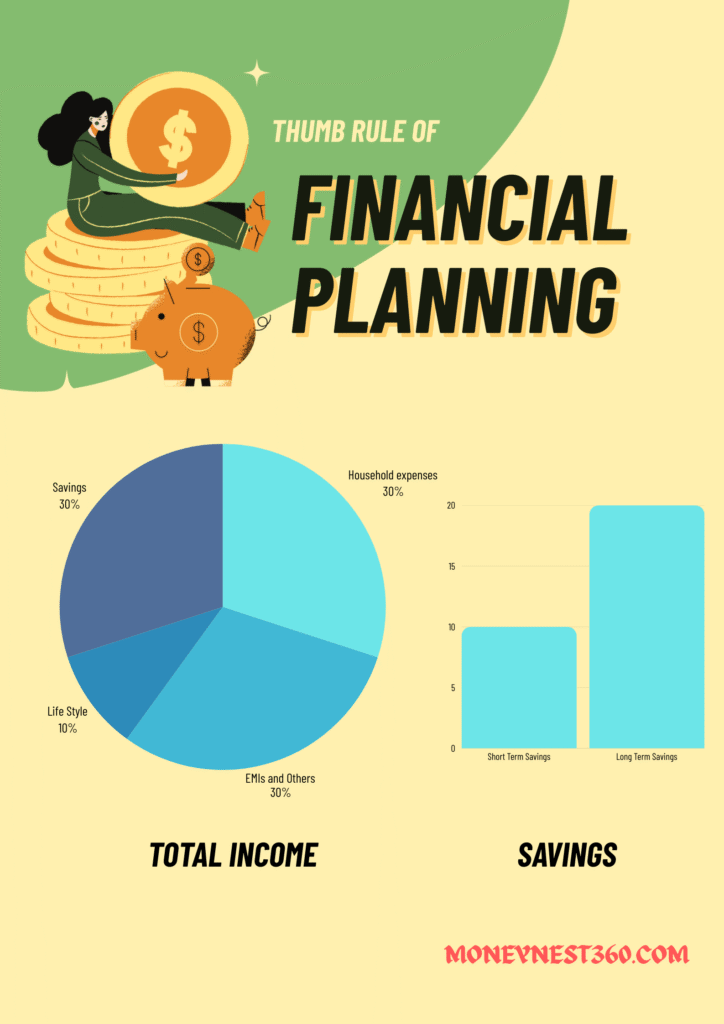

Thumb Rule Of Financial Planning

Most people spend first and then save what is left. But smart financial planning is the opposite.

If you save 30% of your income regularly, you can:

- Build an emergency fund for unexpected situations.

- Secure your children’s education and future needs.

- Create wealth through investments.

Enjoy a peaceful retirement without depending on others. Even if income is small, this 30% rule builds discipline and long-term security.

Also Read: Smart Investment Choices: Amazing Money Growth Tips

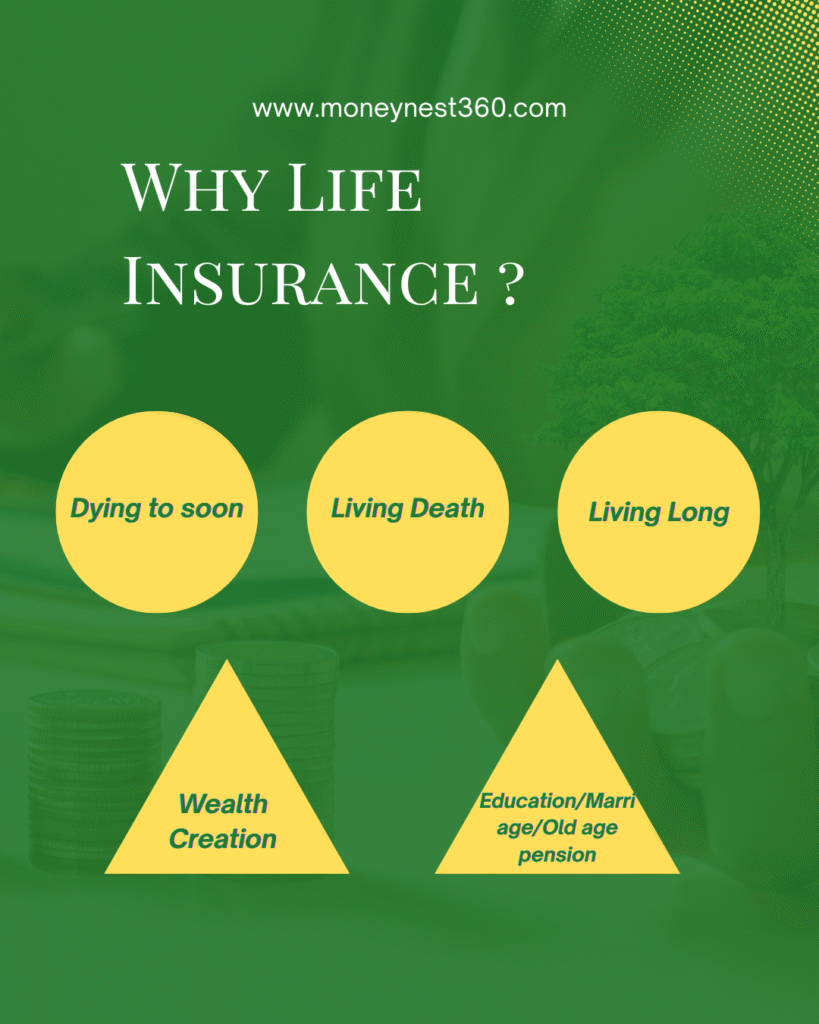

Why Life Insurance Is Important ?

Life insurance is not just about covering death. it is the only financial tool that takes care of every stage of life.

1. Three Probabilities of Life

Dying too soon:

If a person dies early, life insurance gives money to the family to take care of their needs, children’s education, marriage, and daily expenses. Family will not suffer financially.

Click Here: India’s No.1 most trusted insurance company

Living with disability (Living death):

If a person meets with an accident or becomes permanently disabled, income may stop. Insurance provides protection, so that even in such a difficult situation, life can go on without financial struggle.

Living too long:

If a person lives a long life after retirement, they need money to survive without depending on children. Life insurance with savings/retirement plans ensures regular income and financial freedom.

Also Read: Why Life Insurance Is the Smartest Way to Create Wealth and Protect Your Family?

2. Two Priorities of Life

Children’s Education and Marriage: Insurance ensures that even if the earning person is not there, children’s studies and marriage will not stop due to lack of money.

Wealth Creation: Some insurance plans help build wealth over time through savings and investments. This creates a strong financial backup for the future.

Life insurance = Protection + Savings + Wealth Creation.

It is the only instrument that supports us in all 3 probabilities and fulfills 2 main priorities of life

“Decides to set aside 30% right away every month of your income and continues investing till age of 50.”

For more information on the best life insurance plans to suit your need, please feel free to contact us: Click Here

2 thoughts on “What Is the Smartest & Most Effective Way to Plan Your Finances for Life & Future Security?”