Top 10 Term Insurance Plans in India 2025

Term insurance is mainly for protection – it gives your family a fixed amount of money (sum assured) if something happens to you. This ensures your dependents don’t face financial problems.

But in 2025, many insurance companies are making term plans more useful. Apart from protection, they also give extra features like:

- Return of Premium (ROP): If you survive the policy term, you get back the premiums you paid.

- Flexible Payouts: Family can take money as a lump sum or monthly income.

- Riders: Extra covers like critical illness, accidental death, or waiver of premium.

- Increasing Cover: Your cover grows over time to beat inflation.

So now, term insurance is not only about protection, but also about wealth preservation and better financial planning.

Also Read: Right Age to Buy a Term Insurance Plan in India?

What “Wealth + Protection” Means in Term Insurance

A pure term plan is mainly for protection – it pays your family a fixed amount if something happens to you. Normally, it doesn’t create wealth like mutual funds, stocks, or ULIPs.

But in 2025, many term plans are adding wealth-like features so you get both security + financial value. Here’s how:

- Return of Premium (ROP):

If you survive till the end of the policy, the insurance company returns the premiums you paid. It’s like getting your money back while still enjoying full protection. - Increasing Sum Assured (Inflation Protection):

The cover amount increases over time, so the money your family receives doesn’t lose value due to inflation. - Riders (Extra Covers):

Add-ons like Critical Illness cover, Waiver of Premium, Accidental Death Benefit, or Terminal Illness cover. These reduce other financial risks and give more complete protection. - Flexible Payout Options:

Your family can receive the claim as a lump sum, as monthly income, or a mix of both – useful if they need regular cash flow instead of one-time money. - Limited Premium Payment Terms:

Pay premiums only for a few years (say 10–15) but enjoy cover for a much longer period. This gives you breathing room and allows you to invest your saved money elsewhere.

👉 In short: Wealth + Protection term plans don’t directly grow your money like investments, but they give value-adds and flexibility so your family gets maximum financial security without losing money

Below we will look at the Top 10 Term Plans in India (2025) and also understand what you should check before choosing one.

Top 10 Term Insurance Plans in India 2025

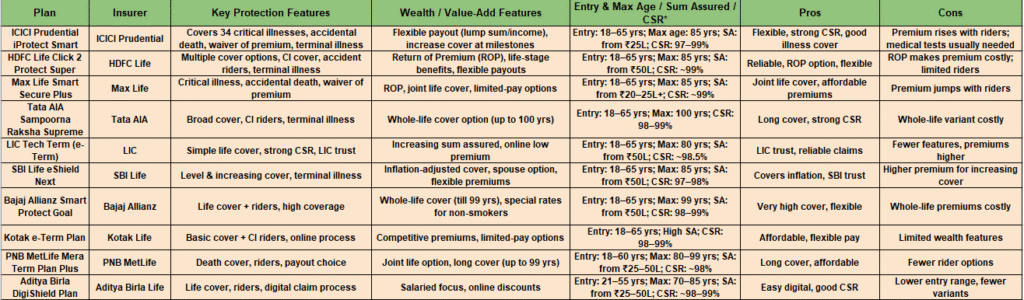

| Plan | Insurer | Key Protection Features | Wealth / Value-Add Features | Entry & Max Age / Sum Assured / CSR* | Pros | Cons |

| ICICI Prudential iProtect Smart | ICICI Prudential | Covers 34 critical illnesses, accidental death, waiver of premium, terminal illness | Flexible payout (lump sum/income), increase cover at milestones | Entry: 18–65 yrs; Max age: 85 yrs; SA: from ₹25L; CSR: 97–99% | Flexible, strong CSR, good illness cover | Premium rises with riders; medical tests usually needed |

| HDFC Life Click 2 Protect Super | HDFC Life | Multiple cover options, CI cover, accident riders, terminal illness | Return of Premium (ROP), life-stage benefits, flexible payouts | Entry: 18–65 yrs; Max: 85 yrs; SA: from ₹50L; CSR: ~99% | Reliable, ROP option, flexible | ROP makes premium costly; limited riders |

| Max Life Smart Secure Plus | Max Life | Critical illness, accidental death, waiver of premium | ROP, joint life cover, limited-pay options | Entry: 18–65 yrs; Max: 85 yrs; SA: from ₹20–25L+; CSR: ~99% | Joint life cover, affordable premiums | Premium jumps with riders |

| Tata AIA Sampoorna Raksha Supreme | Tata AIA | Broad cover, CI riders, terminal illness | Whole-life cover option (up to 100 yrs) | Entry: 18–65 yrs; Max: 100 yrs; CSR: 98–99% | Long cover, strong CSR | Whole-life variant costly |

| LIC Tech Term (e-Term) | LIC | Simple life cover, strong CSR, LIC trust | Increasing sum assured, online low premium | Entry: 18–65 yrs; Max: 80 yrs; SA: from ₹50L; CSR: ~98.5% | LIC trust, reliable claims | Fewer features, premiums higher |

| SBI Life eShield Next | SBI Life | Level & increasing cover, terminal illness | Inflation-adjusted cover, spouse option, flexible premiums | Entry: 18–65 yrs; Max: 85 yrs; SA: from ₹50L; CSR: 97–98% | Covers inflation, SBI trust | Higher premium for increasing cover |

| Bajaj Allianz Smart Protect Goal | Bajaj Allianz | Life cover + riders, high coverage | Whole-life cover (till 99 yrs), special rates for non-smokers | Entry: 18–65 yrs; Max: 99 yrs; SA: from ₹50L; CSR: 98–99% | Very high cover, flexible | Whole-life premiums costly |

| Kotak e-Term Plan | Kotak Life | Basic cover + CI riders, online process | Competitive premiums, limited-pay options | Entry: 18–65 yrs; High SA; CSR: 98–99% | Affordable, flexible pay | Limited wealth features |

| PNB MetLife Mera Term Plan Plus | PNB MetLife | Death cover, riders, payout choice | Joint life option, long cover (up to 99 yrs) | Entry: 18–60 yrs; Max: 80–99 yrs; SA: from ₹25–50L; CSR: ~98% | Long cover, affordable | Fewer rider options |

| Aditya Birla DigiShield Plan | Aditya Birla Life | Life cover, riders, digital claim process | Salaried focus, online discounts | Entry: 21–55 yrs; Max: 70–85 yrs; SA: from ₹25–50L; CSR: ~98–99% | Easy digital, good CSR | Lower entry range, fewer variants |

✅ CSR = Claim Settlement Ratio

It means the percentage of claims an insurance company has settled out of the total claims received in a year.👉 Higher CSR = Better reliability (the company is more likely to pay your family’s claim without hassle).

What to Look Out For Before Buying a Term Plan

Before you choose a term insurance plan, keep these points in mind:

- Choose the Right Sum Assured

- General rule: at least 10–15 times your annual income.

- Adjust for your loans, children’s education, spouse’s needs, and other future goals.

- Pick a Policy Term that Matches Your Life Stage

- Cover till your kids are financially independent.

- Or, till your retirement age.

- Some plans also offer whole-life cover (up to 99/100 years).

- Check Claim Settlement Ratio (CSR) & Financial Strength

- A good CSR (above 97–98%) means the insurer is reliable.

- Also look at the insurer’s solvency and ratings (shows financial strength).

- Understand Riders (Extra Covers)

- Riders like critical illness, accidental death, or waiver of premium are useful.

- But they increase your premium. Add only what you really need.

- Decide Premium Payment Mode

- Yearly, half-yearly, quarterly, or monthly — choose what suits your budget.

- Limited Pay option: pay for 10–15 years but stay covered for much longer.

- Flexibility for Future Changes

- Look for plans that let you increase your cover when life changes (marriage, new child, higher income).

- Check Tax Benefits

- Premiums qualify for Section 80C deductions.

- Claim payouts are tax-free under Section 10(10D) (within limits).

👉 In short: Don’t just look at the premium. Think about your family’s needs, life stage, and the insurer’s reliability

Sample Comparison: Pure Term Plan vs Term with Wealth Option

To make it easy to understand, let’s see how two term plans may look for a 30-year-old, non-smoker, buying ₹1 crore cover for 30 years.

| Feature | Plan A – Pure Term (Low-Cost) | Plan B – Term with Return of Premium (ROP) |

|---|---|---|

| Policy Type | Pure protection (only life cover) | Protection + Return of Premium |

| Premium (per year) | ~₹10,000 | ~₹20,000 |

| Cover Amount | ₹1 crore (fixed) | ₹1 crore (fixed) |

| Payout if Death Happens | ₹1 crore to nominee | ₹1 crore to nominee |

| Payout if Policyholder Survives | ₹0 | Refund of all premiums (~₹6 lakhs over 30 years) |

| Pros | Cheapest way to protect family, high cover at low cost | Protection + money back if you survive |

| Cons | No money back if you survive | Premium is double compared to pure term |

👉 As you can see, both plans give ₹1 crore cover, but the cost and benefits are different.

- Pure Term Plan is best if you want maximum cover at lowest premium.

- ROP Term Plan is best if you want your money back, even if nothing happens.

Also Read: Param Raksha(Complete Protection + Smart Savings Plan) Is The Best ULIP Plan In India

Why Wealth + Protection in Term Insurance Matters

When we think about financial planning, we usually focus on saving and investing. But protection is equally important — because without it, even the best investment plans can collapse in case of an unfortunate event. Here’s why the wealth + protection angle of term insurance is so valuable:

1. Protects Your Earning Potential

If you are the main earning member of your family, your income is what keeps everything running — household expenses, children’s education, EMIs, future goals. Term insurance ensures that if something happens to you, your family still gets a financial cushion to maintain their lifestyle and cover important commitments.

2. Peace of Mind for You & Your Family

Without term insurance, your loved ones may have to liquidate savings or sell investments (like property, gold, or stocks) to survive. Insurance removes this burden and gives peace of mind knowing your family is financially secure.

3. Huge Leverage at Low Cost

One of the biggest advantages of term insurance is that premiums are small compared to the huge sum assured. For example, paying ₹800–₹1,000 per month can get you a cover of ₹1 crore — something no other financial product can match in terms of cost-to-benefit leverage.

4. Complements Your Wealth Creation Plan

Think of insurance as the safety net of your financial journey. You can still invest in mutual funds, stocks, or real estate for growth. But insurance ensures that if anything unexpected happens, those growth plans are not derailed.

👉 In short, wealth + protection ensures your family’s future is safe, while your investments continue to grow undisturbed.

Pros & Cons of Term Plans

Pros ✅

- High cover at low premium

- Riders available for extra protection

- Flexible payouts for family’s needs

- Options like ROP and limited pay add value

Cons ❌

- ROP makes premiums higher than pure term

- No direct wealth growth (not an investment product)

- Cover ends if you survive beyond maturity (except whole-life options)

Conclusion: Secure Protection, Build Peace of Mind

Term insurance is not just about buying a policy — it’s about securing your family’s financial future in the most cost-effective way. By choosing the right plan, with sufficient cover and the right riders, you ensure that your loved ones are protected from life’s uncertainties.

Features like Return of Premium, increasing cover options, flexible payouts, and limited pay terms add a wealth-protection angle, giving you both security and financial flexibility.

Before finalizing, always check the insurer’s Claim Settlement Ratio, policy flexibility, and long-term suitability with your life goals. Remember, the right term insurance plan is one that fits your needs today and adapts to your tomorrow.

✅ Protection first, wealth-smart features second, peace of mind always.

👉 For more services and guidance, reach out to us. We’ll help you choose the best term plan tailored to your financial needs and future goals.

10 Most Common FAQs about Term Insurance

1. What is the best age to buy term insurance?

👉 The earlier, the better. Premiums are lowest when you are young and healthy.

2. Is term insurance refundable if I survive?

👉 Only if you choose a Return of Premium (ROP) plan. Pure term plans don’t refund.

3. How much cover should I take?

👉 Ideally 10–15 times your annual income + your loans.

4. Is LIC better than private companies?

👉 LIC has high trust and strong CSR. But private companies also have ~98–99% CSR with more flexible features.

5. Can NRIs buy term plans in India?

👉 Yes, most insurers allow NRIs to buy term insurance (with some conditions).

6. What is the maximum age till which I can get cover?

👉 Usually up to 85 years. Some plans offer whole life cover till 99–100 years.

7. Are medical tests compulsory?

👉 For high coverage amounts, yes. For smaller cover, sometimes not required.

8. What happens if I miss a premium?

👉 Most plans give a grace period (15–30 days). If not paid, policy lapses.

9. Can I change the nominee later?

👉 Yes, you can update/change nominee any time.

10. Are premiums eligible for tax benefits?

👉 Yes, under Section 80C and Section 10(10D) of the Income Tax Act.