The Smartest Way to Create Wealth and Protect Your Family

Every family has different financial goals — wealth creation, regular income, tax savings, day-to-day savings and, most importantly, protection against unexpected events. Too often people chase only one objective (usually higher returns) and forget the full picture. A good financial plan should balance safety, liquidity and returns, while making sure the family is protected if the breadwinner can’t earn anymore. Below I explain, step by step, why life insurance belongs at the center of that plan and how it compares with other common investments.

Start with family needs (what must be protected first)

Before choosing any product, list the family’s priorities:

- Immediate protection for dependents if the earner dies or becomes disabled.

- Regular income for household expenses and children’s education.

- Long-term wealth creation (house, retirement corpus).

- Tax efficiency to reduce the family’s overall tax burden.

- Liquidity for emergencies.

If even one of these is missing, the family can face serious financial stress. That’s why planning must begin with protection, not with returns alone.

Key Financial Goals Highlighted

1. Wealth Creation – Investing in options that grow money over time (stocks, mutual funds, insurance-linked plans, etc.).

2. Savings – Setting aside money safely for future needs (bank deposits, savings plans, recurring deposits, etc.).

Also Read: Are You Looking For Best Savings Plan?

3. Regular Income – Ensuring a steady cash flow for expenses (pension plans, annuities, income plans).

4. Tax Savings – Reducing taxable income through investments and insurance that offer tax benefits.

5. Protection – Financial protection for the family through life insurance, health insurance, or accident coverage.

“That’s why we have Different Solutions to suit your needs”

👉 This suggests that the company (likely an insurance or financial services provider) offers a range of products to match these goals.

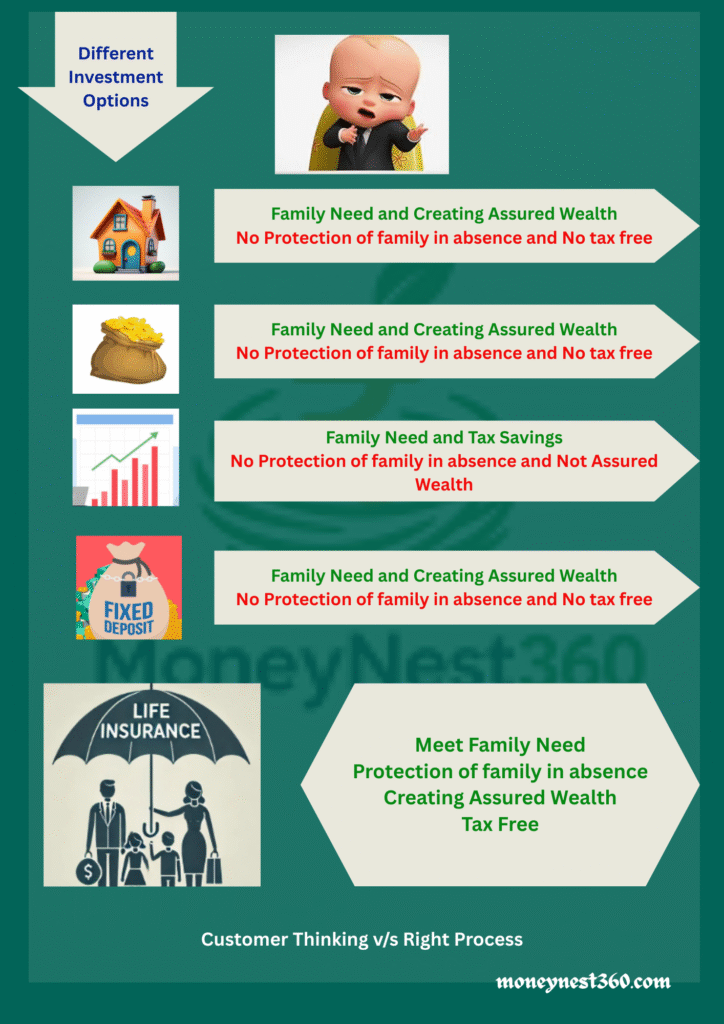

How common investments stack up (returns v/s real-life needs)

People normally think: “Which investment gives the highest return?” But the correct process is to ask: “Which investment meets my family’s needs while keeping money safe and accessible?” Here’s a quick comparison:

Property (Real Estate): Good at creating long-term wealth and acting as a store of value, but it’s illiquid, not tax-efficient in many cases, and doesn’t provide immediate family protection if the earner dies.

Gold: Useful as an inflation hedge and wealth store, but it does not replace income or protect dependents.

Business/Market Investments: Can offer high returns but come with high risk. They won’t guarantee family protection and can even reduce capital in downturns.

Fixed Deposits / Bank Savings: Safe and liquid but offer modest returns and limited tax benefits. No protection cover for family.

Insurance (life & certain endowment/ULIP plans): Provides family protection, a guaranteed sum assured (in many products), potential wealth creation, and tax benefits under applicable laws.

Key Investment Options Compared

1. Property (Real Estate)

Meets family need: ✅

Protection of family in absence: ❌

Creating assured wealth: ✅

Tax efficient: ❌

2. Gold

Meets family need: ✅

Protection of family in absence: ❌

Creating assured wealth: ✅

Tax efficient: ❌

3. Marketing Investment (like business, trading, etc.)

Meets family need: ❌

Protection of family in absence: ❌

Creating assured wealth: ✅

Tax efficient: ❌

4. Fixed Deposits (FDs)

Meets family need: ✅

Protection of family in absence: ❌

Creating assured wealth: ✅ (but limited returns)

Tax efficient: ❌

5. Insurance

Meets family need: ✅

Protection of family in absence: ✅

Creating assured wealth: ✅

Tax efficient: ✅

👉 This shows only insurance covers all 4 dimensions: family needs, protection, wealth creation, and tax benefits.

Also Read: What Is the Smartest & Most Effective Way to Plan Your Finances for Life & Future Security?

Why life insurance is both protection and a wealth-building tool

Life insurance is often thought of as “expense” rather than “investment”. That’s a misconception. When structured well, life insurance delivers a combination no other single product offers:

Key Benefits Listed

Protection for dependents: In the event of the policyholder’s death, the family receives the sum assured immediately, which replaces lost income and secures goals like education and home payments.

Assured or guaranteed benefits: Many life products guarantee a minimum payout (sum assured) or provide maturity benefits plus bonuses — so there’s a degree of certainty that pure market investments cannot give.

Tax advantages: Premiums and benefits often enjoy tax treatment (e.g., deductions under Section 80C or tax-exempt maturity/death benefits under Section 10(10D) in typical Indian rules — check current laws and policy terms).

Capital protection and peace of mind: Unlike volatile market investments, several insurance plans prioritize capital protection and stable growth. That stability reduces stress and allows families to plan long-term.

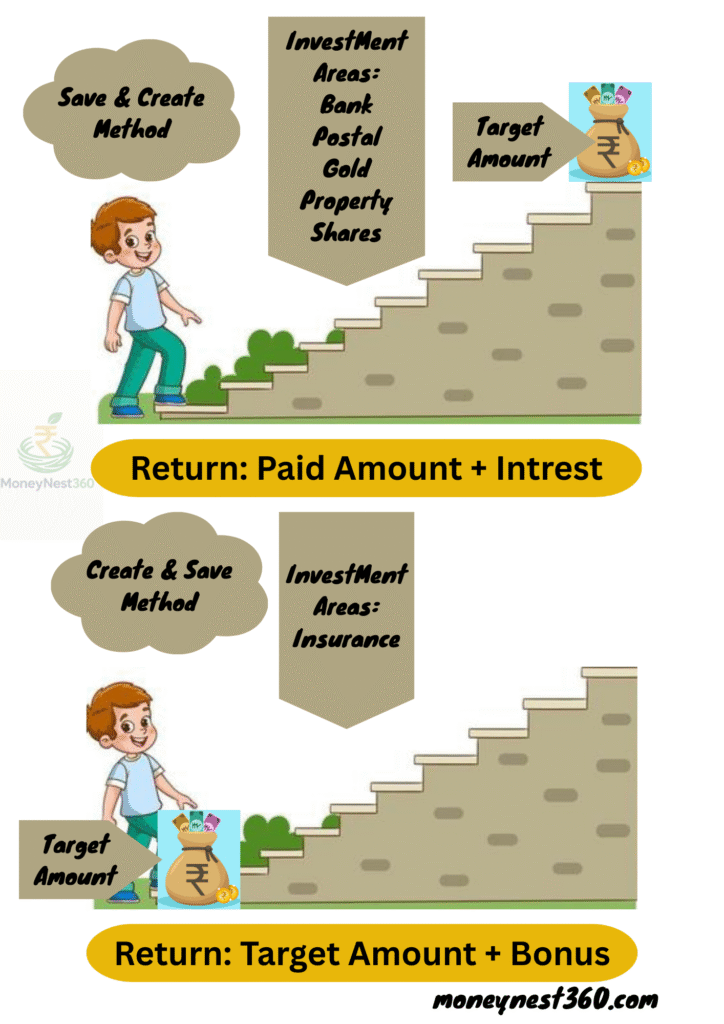

Save & Create Method v/s Create & Save Method

1. Save & Create Method

How it works:

You start saving in postal deposits, gold, bank, shares, mutual funds, or real estate.

Over time, through small contributions plus interest/returns, you gradually build up to your target amount of ₹50 lakhs.

You only get your paid amount + interest after years of savings and growth.

👉 Drawback:

If something happens to the breadwinner before reaching the target, the family won’t have the full ₹50 lakhs immediately.

—

2. Create & Save Method (Insurance Concept)

How it works:

The target amount (₹50 lakhs) is created from Day 1 through Insurance ( like TATA AIA insurance.)

Even if you pay only the first premium, your family gets the full target amount in case of your absence.

At maturity, you get back the target amount + bonus.

👉 Advantage:

Your family’s financial goal (₹50 lakhs) is guaranteed from the start, not just at the end of the saving period.

—

Key Difference Explained

Save & Create (traditional savings): Build wealth slowly → Return = Paid Amount + Interest.

Create & Save (TATA AIA insurance): Wealth created instantly → Return = Target Amount + Bonus.

Also Read: The Golden Rule of Investment: Follow the 30% Rule + 6 Essential Steps

A short, practical example for Why Life Insurance Is the Smartest Way to Create Wealth and Protect Your Family

Imagine a father planning a ₹50 lakh education fund for two children. With traditional saving, he would need many years of disciplined savings to accumulate that amount — and if he dies early, the corpus may be nowhere near ₹50 lakh. A suitable life insurance plan, however, can promise the ₹50 lakh sum assured from policy inception; the family’s education goal remains protected even if the saver is lost unexpectedly.

Conclusion

how to use insurance inside a balanced plan. Life insurance is not a rival to mutual funds, real estate or FDs, it complements them. Use insurance first to secure goals and protect dependents, then use other investments to enhance returns, provide liquidity and diversify risk.

In short: start with protection (a life cover sized to your family’s needs), then build wealth through a mix of safe and growth assets. For most families, the “Create & Save” model centered on life insurance gives the best combination of security, tax efficiency and long-term certainty.

As a financial advisor, I understand that every family’s financial goals are unique. If you would like to explore the best life insurance plans tailored to your specific needs, please feel free to contact us. I’ll help you choose the right plan that ensures protection, wealth creation, and peace of mind for your loved ones.

Your honesty and vulnerability in sharing your personal experiences is truly admirable It takes courage to open up and I applaud you for it